Should you’re a fan of maximizing your rewards, travelling for much less, or getting somewhat further out of your funding technique, this can be a promotion price noting.

From Could 1 to July 31, 2025, TD Direct Investing is giving new and present purchasers the possibility to earn as much as 1,000,000 Aeroplan factors if you switch exterior property right into a TD Direct Investing account.1

Whether or not you’re investing for retirement, a house, or your subsequent journey, this provide is an distinctive alternative to earn worthwhile factors whereas consolidating your funds.

Let’s take a more in-depth have a look at how this provide works, why TD Direct Investing is a best choice for self-directed buyers, and easy methods to take full benefit of the rewards.

How the TD Direct Investing Aeroplan Take Flight Provide Works

The promotion rewards purchasers with tiered Aeroplan factors primarily based on the full worth of exterior property transferred into an eligible TD Direct Investing account.1

You will need to register for the provide utilizing the promo code AEROPLAN2025 by July 31, 2025, and provoke a switch of $10,000 or extra inside 30 days of registering for the provide.

The tiers begin at $10,000 for 10,000 Aeroplan factors and go all the best way as much as 1,000,000 factors for transfers of $2 million or extra.

Bonus factors are paid out in three instalments so long as your stability is maintained:

- 25% by November 30, 2025

- 25% by April 30, 2026

- 50% by August 31, 2026

For instance, If register for the promotion earlier than July 31, 2025 and switch $250,000 inside 30 days, you’ll obtain 37,500 Aeroplan factors by November 30, 2025, one other 37,500 factors by April 30, 2026, and the remaining 75,000 by August 31, 2026.

You will need to preserve the total worth of your qualifying property in your account(s) all through the whole holding interval. Should you withdraw greater than 5% of your stability, you’ll forfeit any remaining factors.

Qualifying property should come from an exterior monetary establishment that’s not a part of TD Financial institution Group. Transfers from TD Canada Belief, TD Wealth, or TD Direct Investing accounts usually are not eligible for this provide.

Additionally, property which have beforehand obtained bonuses from different TD promotions are excluded.

Why Aeroplan Factors Are So Worthwhile

Aeroplan is without doubt one of the most versatile and rewarding loyalty packages in Canada, with flight redemptions obtainable on Air Canada and over 45 airline companions.

Whether or not you’re trying to fly short-haul in economic system or take pleasure in lie-flat seats in worldwide enterprise class, Aeroplan gives great worth, particularly when used strategically.

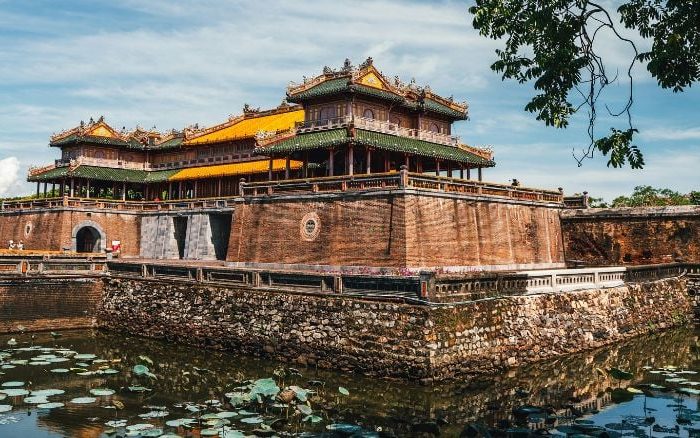

For instance, a one-way enterprise class flight on ANA from Vancouver to Tokyo can price as little as 55,000 Aeroplan factors. With the very best tier on this provide, that’s sufficient for over 9 spherical journey enterprise class flights to Japan, a dream journey for any Asia-bound traveller.

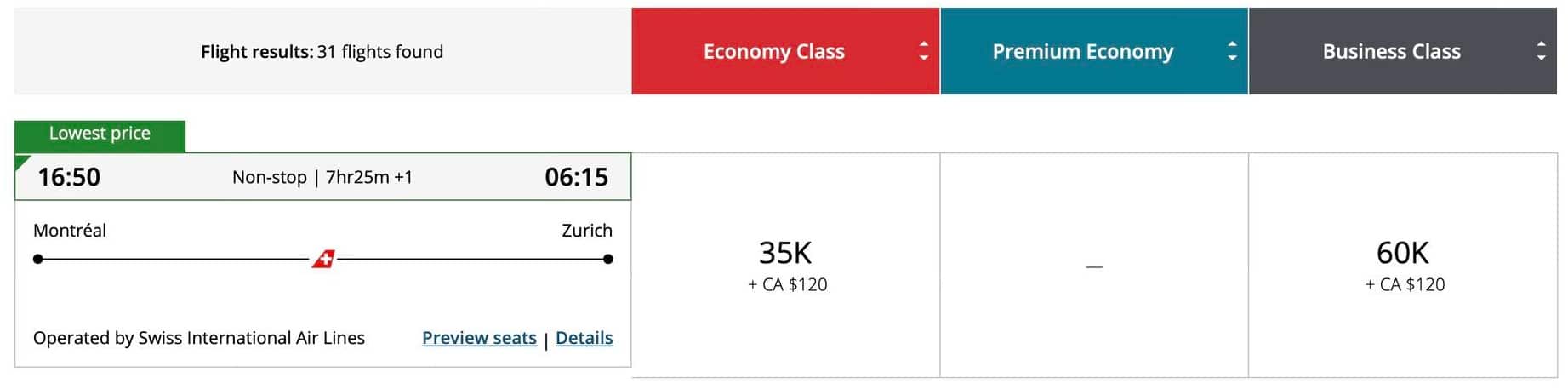

And it’s not simply restricted to ANA. If Europe is looking, a one-way enterprise class flight from Montreal to Zurich on SWISS can go for as little as 60,000 Aeroplan factors.

And with Aeroplan’s huge community of 45+ airline companions and stopovers for simply 5,000 further factors, you’ll be able to stretch your factors additional than nearly every other program in Canada.

Whether or not you’re planning to fly in model or stretch your factors on a number of economic system redemptions, this provide might be your likelihood to spice up your stability considerably—and begin reserving the sorts of journeys you didn’t assume have been potential.

Eligible Accounts and Transfers

This provide applies to a broad number of account sorts, together with private and company funding accounts:

- Money (single or joint account holder)

- Margin (single or joint account holder)

- Tax-Free Financial savings Account (single account holder) (TFSA)1

- Registered Retirement Financial savings Plan (single account holder) (RRSP)1

- Registered Training Financial savings Plan (single account holder) (RESP)2

- Self-Directed Locked-In Retirement Accounts (LIRA)1

- Self-Directed Locked-In Retirement Financial savings Plan (LRSP)3

- Company Account

Account(s) not eligible for the provide embody:

- Any non-personal accounts apart from company

- Retirement Revenue Fund (RIF)1

- Life Revenue Fund (LIF)1

- Registered Incapacity Financial savings Plan (RDSP)1

- First Dwelling Financial savings Account (FHSA)1

You’ll have to switch web new property from exterior the TD ecosystem. That features shares, ETFs, GICs, mutual funds, and money. Transfers from one other TD account, resembling TD Wealth or TD Direct Investing, aren’t eligible.

Credit score Card Requirement: Which Playing cards Qualify

So as to take part, you’ll additionally want to carry an eligible TD Aeroplan bank card in good standing as of July 31, 2025, and hold it energetic till August 31, 2026.

The listing of eligible TD Aeroplan bank cards consists of the next:

However this isn’t only a technical requirement. It’s additionally an effective way to speed up your Aeroplan incomes technique.

TD Aeroplan playing cards are among the many most rewarding co-branded playing cards in Canada, providing beneficiant welcome bonuses, excessive earn charges on on a regular basis purchases, and built-in journey advantages that improve your Aeroplan membership.

TD® Aeroplan® Credit score Playing cards

Relying on the cardboard, you might earn as much as 85,000 Aeroplan factors as a welcome bonus, factors that stack completely with the Direct Investing bonus.

You’ll additionally earn as much as 1.5–2x Aeroplan factors on eligible purchases like groceries, gasoline, and journey, permitting you to continue to grow your stability even after the funding bonus pays out.

On prime of that, TD Aeroplan playing cards unlock most popular pricing on Aeroplan redemptions for Air Canada flights, and a few playing cards even include free first checked baggage, Maple Leaf Lounge entry, or Precedence Airport Advantages when flying with Air Canada.

In different phrases, holding a TD Aeroplan card isn’t nearly ticking a field. It’s about unlocking much more worth from the factors you earn by means of this investing promotion. Should you don’t already maintain one, now’s the proper time to use and double-dip on rewards.

What Makes TD Direct Investing a Sturdy Platform?

For anybody trying to handle their very own portfolio, TD Direct Investing is a self-directed investing brokerage platform operated by TD Waterhouse Canada Inc., a subsidiary of The Toronto-Dominion Financial institution.

Shoppers can entry markets utilizing WebBroker, TD’s desktop buying and selling device, or use the cellular app to handle their account on the go. There’s additionally an Superior Dashboard for energetic merchants, full with real-time quotes, customizable layouts, and streaming information.

You’ll even have entry to a broad vary of funding choices. TD Direct Investing helps buying and selling in Canadian and U.S. shares, ETFs, mutual funds, bonds, and GICs. IPO participation is accessible too, as are instruments for managing registered and non-registered accounts.

Value Concerns

Whereas TD Direct Investing isn’t the most affordable platform available on the market, it’s aggressive—particularly if you issue within the dimension of the Aeroplan bonus.

Inventory trades price $9.99 every for many customers, and drop to $7.00 if you happen to commerce at the very least 150 instances per quarter. Choices contracts price a further $1.25 per contract.

Mutual fund purchases are commission-free, and account upkeep charges are waived in case your family holds at the very least $15,000 in property throughout eligible TD Direct Investing accounts.

One factor to bear in mind is the $150 transfer-out charge per account if you happen to select to maneuver your property elsewhere afterward.

That mentioned, with a possible 1,000,000 Aeroplan factors on the desk, the upfront worth far outweighs that price for many purchasers.

Tips on how to Qualify and Optimize the Provide

To benefit from the TD Direct Investing Aeroplan provide, timing and technique matter.

Begin by registering for the provide utilizing the promo code AEROPLAN2025 by July 31, 2025. You’ll have 30 days from registration to provoke your switch, and 60 days to finish it.

Further contributions will be made up till August 31, 2025, and can rely towards your qualifying whole.

To obtain your full bonus, preserve your Aeroplan-eligible bank card and hold your account stability intact till August 31, 2026. Keep away from withdrawing greater than 5% of your transferred property otherwise you’ll threat forfeiting remaining factors.

Should you’re simply shy of a better tier, contemplate topping up your account or consolidating throughout a number of TD accounts (together with household-linked accounts) to succeed in an even bigger bonus.

Conclusion

The TD Direct Investing 2025 Aeroplan Take Flight Provide is without doubt one of the most rewarding brokerage promotions we’ve seen in Canada.

With the possibility to earn as much as 1,000,000 Aeroplan factors, it bridges the hole between monetary technique and journey rewards in a method that’s exhausting to disregard.

Should you’ve been fascinated about consolidating your investments or switching platforms, this provide makes it nicely price doing so. Add within the capacity to pair the promotion with a TD Aeroplan bank card, and also you’re an extremely highly effective combo for rising your factors stability.

Whether or not you’re chasing a bucket-list journey or simply desire a smarter option to make investments, this promotion provides you a singular option to obtain each targets directly.

Disclaimer

All emblems are the property of their respective homeowners.

®Aeroplan is a registered trademark of Aeroplan Inc., used below license.

®The Air Canada maple leaf emblem is a registered trademark of Air Canada, used below license.

*Trademark of Visa Worldwide Service Affiliation and used below license.

TD Direct Investing, TD Wealth Monetary Planning and TD Wealth Personal Funding Recommendation are divisions of TD Waterhouse Canada Inc., a subsidiary of The Toronto-Dominion Financial institution.

TD Straightforward Commerce™ is a service of TD Direct Investing, a division of TD Waterhouse Canada Inc., a subsidiary of The Toronto-Dominion Financial institution.

TD Wealth Monetary Planning Direct is a service providing from TD Wealth Monetary Planning, a division of TD Waterhouse Canada Inc., a subsidiary of The Toronto-Dominion Financial institution.

TD Wealth Personal Funding Counsel represents the services supplied by TD Waterhouse Personal Funding Counsel Inc., a subsidiary of The Toronto-Dominion Financial institution.

TD Wealth Personal Banking providers are supplied by The Toronto-Dominion Financial institution.

TD Wealth Personal Belief providers are supplied by The Canada Belief Firm.

TD Financial institution Group means The Toronto-Dominion Financial institution and its associates, who present deposit, funding, mortgage, securities, belief, insurance coverage and different services or products.