When you’ve been launched to the world of Miles & Factors, you’ll doubtless start in search of methods to earn bank card factors on completely the whole lot you spend cash on.

In Canada, Chexy gives a digital platform that permits Canadians to cost lease, invoice funds, and taxes to your bank card in change for a nominal charge.

As we’ll discover, Chexy is a key device for savvy Miles & Factors fans to pad their factors balances by unlocking rewards on virtually each expense that sometimes doesn’t permit bank card funds.

For those who’re signing up for Chexy, think about doing so via the Prince of Journey referral hyperlink, which helps to help the web site.

What Is Chexy?

Chexy is Toronto-based startup that permits you to pay your lease, payments, and taxes utilizing a bank card (for a nominal charge).

Chexy not solely makes funds extra handy, but in addition means that you can earn perks and rewards, and even construct credit score via the Chexy platform.

For those who’ve been within the sport for some time, you may discover that the idea is much like RBC Ventures’s GetDigs, which was sadly shut down in late 2020. Chexy –which launched in 2022 – is right here to remain, although, and it has large ambitions to develop within the rental and funds house.

Pay Lease, Payments, and Taxes By means of Chexy

Chexy gives Canadians a user-friendly digital platform for paying lease, payments, and taxes utilizing a bank card. You possibly can arrange your account and funds on the Chexy web site.

By and enormous, the method for establishing funds for lease, payments, and taxes on the Chexy platform is identical.

You’ll first must create an account with Chexy, after which you’ll be able to select to arrange recurring funds, pay one-time payments, or pay revenue taxes.

Below the recurring payments function, you’ll be able to arrange computerized funds every month for lease, automotive lease funds, insurance coverage funds, condominium/strata charges, web/cable payments, and extra.

Below the invoice cost function, you’ll be able to arrange one-off funds to a number of payees, simply as you’ll with on-line banking. It is a nice possibility for funds with quantities that change, corresponding to utility payments, telephone payments, tuition, daycare/childcare, property taxes, and extra.

Below the pay revenue taxes function, you may make one-time funds to the Canada Income Company or Revenu Quebec.

Formally, Chexy has three merchandise: Chexy Lease (for lease funds), Chexy Pockets (for recurring and one-time invoice funds), and Chexy Tax (for tax funds).

Setting Up Lease Funds

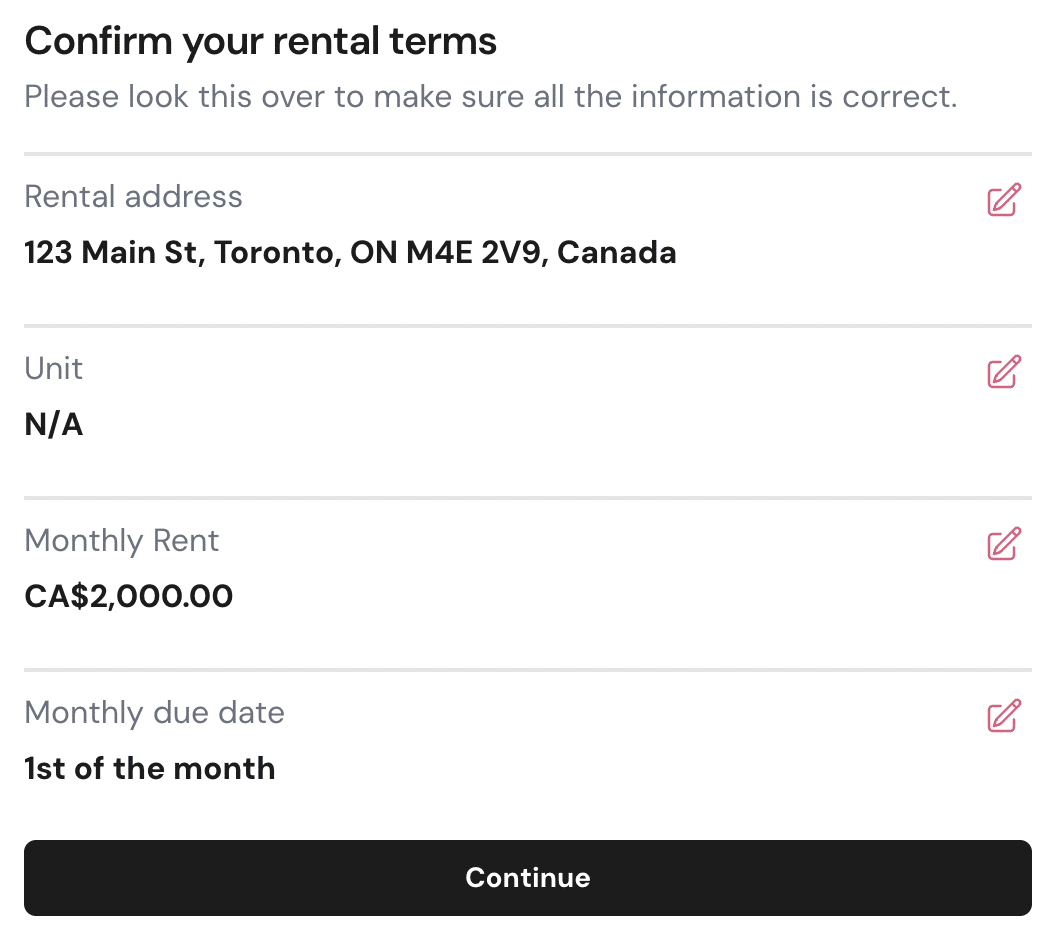

Let’s use the instance of establishing a recurring lease cost in your account, whereas acknowledging that the method for establishing invoice funds and tax funds via Chexy is basically comparable.

To arrange a recurring lease cost, you’d first must enter your landlord and rental info, together with your month-to-month lease and cost date. Funds could be made through Interac e-Switch, pre-authorized debit, or Invoice Pay, relying in your landlord.

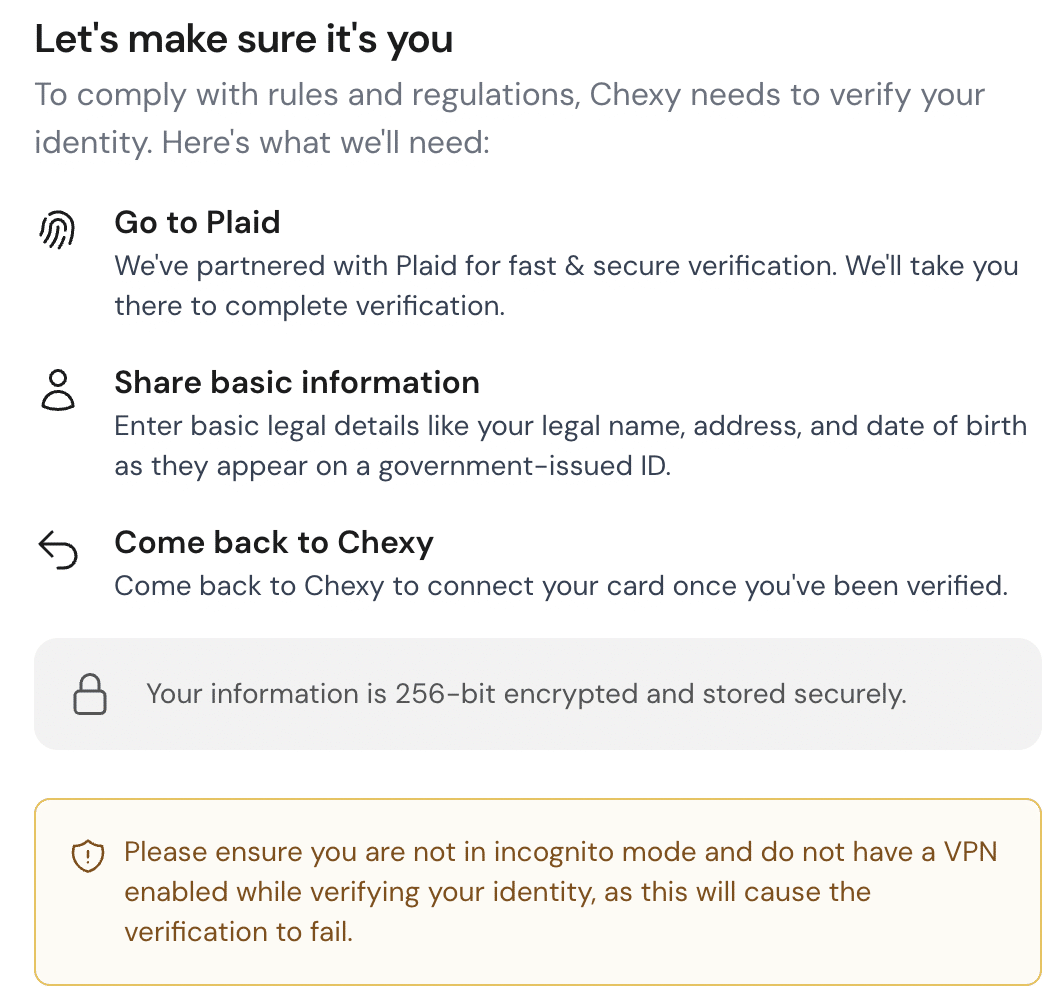

Then, as a verification measure, you’ll must confirm your identification by clicking via to Plaid, an establish verification service that Chexy companions with. The method takes only a few minutes, and also you’ll be requested to offer some info and photograph identification.

As soon as your identification has been verified, you’re prepared so as to add your bank card to your account and begin paying lease.

Establishing Invoice Funds

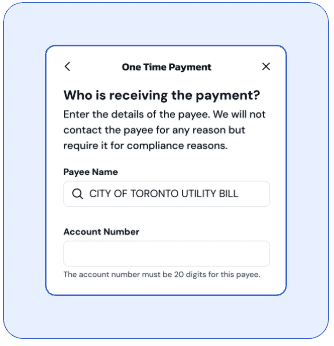

On the subject of establishing recurring or one-time invoice funds, you’ll be able to both manually enter within the payee info, or you’ll be able to seek for many frequent payees utilizing the Invoice Pay function.

As you’re establishing your cost, merely seek for your payee, choose it from the checklist, and add your account quantity.

How Chexy Processes Your Funds

With lease, invoice, and tax funds arrange in your account, Chexy will cost your bank card three days earlier than your indicated due date. Then, the funds are added to your Chexy Pockets, the place they continue to be till it’s time for Chexy to concern the cost.

Then, in your cost’s due date, Chexy points the funds to your payee by means of Interac e-Switch, pre-authorized debit, or Invoice Pay – whichever possibility you’ve chosen.

Many members of the Prince of Journey staff use the service to pay lease, payments, and taxes, and we’re completely satisfied to report that the method works seamlessly.

Chexy’s Processing Charges

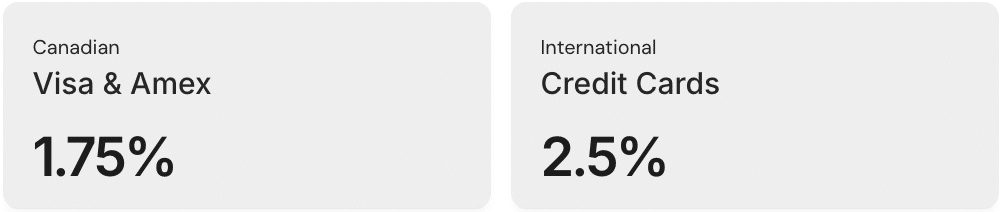

Importantly, Chexy expenses a processing charge for every transaction, starting from 1.75–2.5%.

Canadian-issued American Categorical and Visa playing cards are topic to a 1.75% charge, whereas worldwide American Categorical, Mastercard, and Visa merchandise are topic to a 2.5% processing charge. Presently, Canadian-issued Mastercard merchandise aren’t accepted.

Of all of the invoice cost platforms in Canada, together with PaySimply and Plastiq, Chexy has the bottom processing charges (for Canadian-issued playing cards). Plus, you’ll be able to scale back your processing charges by referring others to the Chexy platform (as detailed beneath).

Construct Your Credit score with Chexy

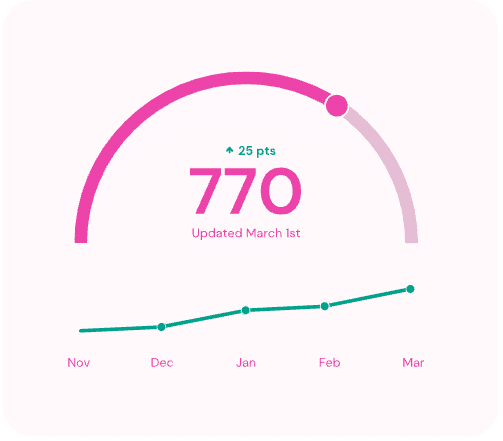

A free add-on obtainable to Chexy members who pay lease utilizing the platform is the Credit score Builder, which helps to bolster your credit score rating by reporting on-time lease funds to Equifax.

Since your lease funds are automated, it gained’t take lengthy to your credit score rating to point out optimistic indicators of development (assuming you’re paying off your bank card in full each month, too).

Plus, you’ll be capable of present any future landlords a verified historical past of on-time lease funds, too.

Chexy’s Referral Program

One other perk of utilizing Chexy is its refer-a-friend program. Upon signing up via a referral hyperlink, your buddy will get $15 (CAD) and also you additionally get $15 (CAD) in credit that you should utilize in direction of your subsequent month-to-month lease cost.

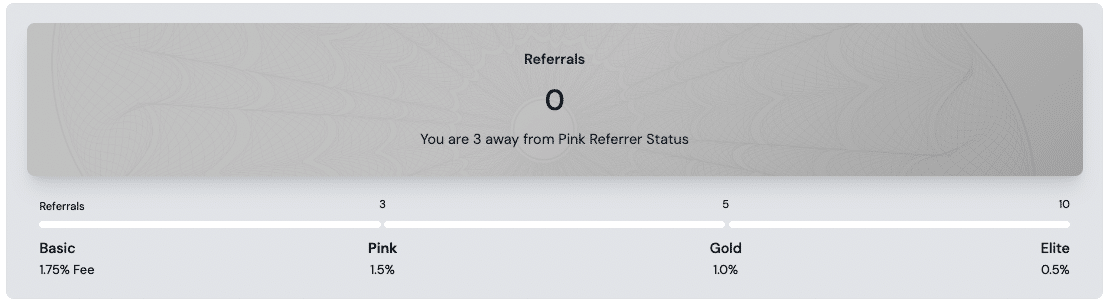

Plus, you’ll be able to unlock decrease processing charges by racking up referrals annually.

Three profitable referrals will get you Pink Referrer Standing, which lowers your processing charge to 1.5%. 5 profitable referrals will grant you Gold Referrer Standing and a 1% processing charge, and 10 profitable referrals comes with Elite Referrer Standing and the bottom 0.5% processing charge.

The referral rely resets annually in January.

Maximize Lease, Invoice, and Tax Funds with Chexy

For Canadians, Chexy is a key device to succeed in your Miles & Factors targets, because it means that you can earn rewards on a few of your greatest recurring and one-off bills.

As we’ll discover beneath, by pairing the correct bank card technique with the Chexy platform, you’ll quickly discover your rewards stability overflowing with factors, which you’ll be able to then flip into elevated journey experiences.

Leverage Minimal Spending Necessities

Among the finest methods to leverage Chexy’s platform is to use your lease, invoice, and tax funds to chip away at minimal spending necessities and unlock giant welcome bonuses.

Usually talking, bank cards that supply probably the most beneficiant welcome bonuses include an equally giant minimal spending requirement. For many individuals, the thought of spending $10,000 or extra in three months is just too daunting to contemplate.

Nonetheless, Chexy’s platform means that you can take giant chunks out of any minimal spending requirement, which in flip may help you unlock one of the best welcome gives on the market.

For instance, suppose you’ve your eye on the welcome bonus for the American Categorical Platinum Card, which gives a welcome bonus of as much as 100,000 Membership Rewards factors, damaged down as follows:

- Earn 70,000 Membership Rewards factors upon spending $10,000 within the first three months

- Earn 30,000 Membership Rewards factors upon making a purchase order in months 14–17 as a cardholder

American Categorical Platinum Card

- Earn 70,000 MR factors upon spending $10,000 within the first three months

- Plus, earn 30,000 MR factors upon making a purchase order in months 14–17 as a cardholder

- Earn 2x MR factors on all eating and journey purchases

- Obtain an annual $200 journey credit score

- Obtain an annual $200 eating credit score

- Switch MR factors to Aeroplan and different frequent flyer applications for premium flights

- Limitless airport lounge entry for you and one visitor at Precedence Move, Plaza Premium, Centurion, and different lounges

- Credit and rebates for each day bills all year long with Amex Provides

- Bonus MR factors for referring household and pals

- Annual charge: $799

With Chexy, you should utilize your American Categorical Platinum Card to cowl your lease, one-off and recurring payments (together with sizeable bills corresponding to automotive lease funds, daycare, strata/condominium charges, and extra), and tax funds (together with one-off funds, recurring tax instalments, and property taxes).

All through a lot of the 12 months – and particularly throughout tax season or at any time when you’ve a big invoice due – the mixture of those funds ought to simply convey you near (or over) the minimal spending requirement, which then considerably boosts your Membership Rewards stability in a brief period of time.

Once more, you’ll must issue within the processing charge of 1.75% in your bills; nonetheless, since welcome bonuses stay the quickest option to enhance your factors stability, Chexy’s platform is a key device for assembly the upper spends.

This similar method works for any card with a excessive minimal spending requirement and a juicy welcome bonus.

And, in the event you’re within the Miles & Factors world with a big different, the alternatives abound.

Get Outsized Worth from Your Factors

One of many first questions that comes up is whether or not or not the processing charge charged by Chexy is price it. In spite of everything, incomes factors this manner comes at an extra value that you simply don’t sometimes incur when utilizing your bank card at conventional retailers.

For probably the most half, the reply merely lies in whether or not or not you’re incomes the correct sort of factors, since not all factors are created equally.

In Canada, one of the best factors to earn for journey are American Categorical Membership Rewards factors, RBC Avion factors, and Aeroplan factors.

Membership Rewards and Avion factors supply probably the most flexibility with how one can redeem them, as you’ll be able to offset the price of journey at a hard and fast fee, enhance your worth additional via the American Categorical Fastened Factors Journey Program or the RBC Air Journey Redemption Schedule, or switch your factors out to airline and/or resort loyalty applications (which have a tendency to supply one of the best worth).

For its half, Aeroplan is likely one of the finest loyalty applications on the earth, due to its lengthy checklist of redemption companions and alternatives to attain outsized worth.

On the subject of crunching the numbers, we worth Aeroplan factors at 2.1 cents per level, American Categorical Membership Rewards factors at 2.2 cents per level, and RBC Avion factors at 2 cents per level.

Assuming that you simply’ll earn rewards with most journey bank cards’ baseline incomes fee of 1 level per greenback spent, we’d estimate that you simply’re getting a return of two–2.2% by paying your lease, payments, and taxes utilizing an Aeroplan, American Categorical, or RBC Avion card with Chexy. For those who subtract the 1.75% charge (or much less in the event you’ve racked up some referrals), you’re nonetheless popping out forward.

Plus, in the event you handle to redeem your factors for even better worth by leveraging candy spots in loyalty applications, you’ll be able to come out even additional forward.

Pair Funds with the Greatest Incomes Charges

One other vital issue to contemplate if you’re trying to get probably the most out of your bank card spending and Chexy is to pair your funds with one of the best incomes charges. That is particularly vital in the event you’re not engaged on a minimal spending requirement, because you’ll wish to maximize the return on spending.

For those who’re trying to earn journey rewards, then your finest guess is to pay your lease, payments, and taxes with a card that has the best baseline incomes fee.

In Canada, your finest choices are the Enterprise Platinum Card from American Categorical (which gives 1.25 Membership Rewards Factors per greenback spent), the RBC® Avion Visa Infinite Privilege† (which gives 1.25 RBC Avion factors per greenback spent).

Credit score Playing cards with Excessive Baseline Incomes Charges

For the reason that lease, invoice, and tax funds you make via Chexy can actually add up over the course of a 12 months, the additional 0.25 factors per greenback spent can meaningfully enhance your stability, particularly in the event you think about your spending exterior of the platform, too.

For instance, for every $2,000 lease cost you make, you’d earn 2,543 Membership Rewards factors on the $2,035 cost (factoring in Chexy’s charge). We’d worth 2,543 Membership Rewards factors at $55.95, which simply outweighs the $35 charge.

Over the course of a 12 months, that additional 0.25 factors per greenback spent provides as much as an additional 6,096 Membership Rewards factors (which we’d worth at $133) versus paying with a card that earns 1 level per greenback spent. And once more, that is only a single sort of cost with the cardboard, and the quantity of rewards you’ll be able to earn actually provides up over time.

For those who’re trying to earn money again as an alternative of journey rewards, you’ll be completely satisfied to know that your lease, invoice, and tax funds code as a recurring invoice cost.

Which means you can use, say, the Scotia Momentum® Visa Infinite* Card, which earns a 4% money again on groceries and month-to-month recurring funds.

Factoring in Chexy’s 1.75% charge, you’d nonetheless web 2.25% money again in your lease, payments, and tax funds.

Suppose you pay $2,000 in lease every month, you’d pay a complete of $2,035 together with Chexy’s charge, whereas nonetheless incomes $81.40 in money again every month on the Scotia Momentum® Visa Infinite* Card.

Subtract the $35 charge you paid, and also you’re nonetheless getting a really respectable $46.40 as an efficient rebate in direction of your lease.

Scotia Momentum® Visa Infinite* Card

- Earn 10% money again within the first three months, as much as $200 complete money again for spending $2,000

- Plus, earn 4% money again on groceries and recurring invoice funds

- Additionally, earn 2% money again on gasoline and transit

- Minimal revenue: $60,000 private or $100,000 family

- Annual charge: $120 (waived for the primary 12 months)

Conclusion

Chexy gives a platform so that you can pay with a bank card and earn rewards in your lease, payments, and tax funds. The service expenses your card three days earlier than your cost due date after which sends an Interac e-Switch, pre-authorized debit, or invoice cost to your payee in your behalf.

By paying these bills with bank cards via Chexy with a 1.75% charge, you’re capable of issue a serious quantity of bills into your Miles & Factors targets.

You should use Chexy to assist attain a excessive minimal spending requirement for a brand new bank card, or you’ll be able to web a tidy sum of factors with one other card with a excessive return on common spending.

For those who’re signing up for Chexy, think about doing so via the Prince of Journey referral hyperlink, which helps to help the web site.