Earlier this 12 months, BMO launched two brand-new co-branded bank cards at the side of Porter Airways.

As a reminder, the introductory provides on the BMO VIPorter World Elite®* Mastercard®* and the BMO VIPorter Mastercard®* convey aggressive welcome bonuses of as much as 70,000 VIPorter factors and useful Porter-specific advantages to cardholders.

When you’re a frequent Porter flyer or trying to broaden your journey rewards into the Porter Airways ecosystem, these provides deserve critical consideration for reinforcing your VIPorter stability and elevating your journey expertise forward of your subsequent journey.

BMO VIPorter World Elite®* Mastercard®*: As much as 70,000 VIPorter Factors!

BMO’s flagship Porter Airways co-branded card is the BMO VIPorter World Elite®* Mastercard®*, which instructions an annual charge of $199 that’s rebated within the first 12 months as half of the present supply.†

New cardholders are eligible for a welcome bonus that delivers as much as 70,000 VIPorter factors† via a three-tiered construction, outlined as follows:

- Earn 20,000 VIPorter factors upon spending $5,000 within the first 110 days†

- Earn an extra 20,000 VIPorter factors upon spending $9,000 within the first 180 days†

- Earn an extra 30,000 VIPorter factors upon spending $18,000 within the first three hundred and sixty five days†

We worth VIPorter factors conservatively at 1.5 cents apiece, which signifies that the whole welcome bonus alone is value roughly $1,050.

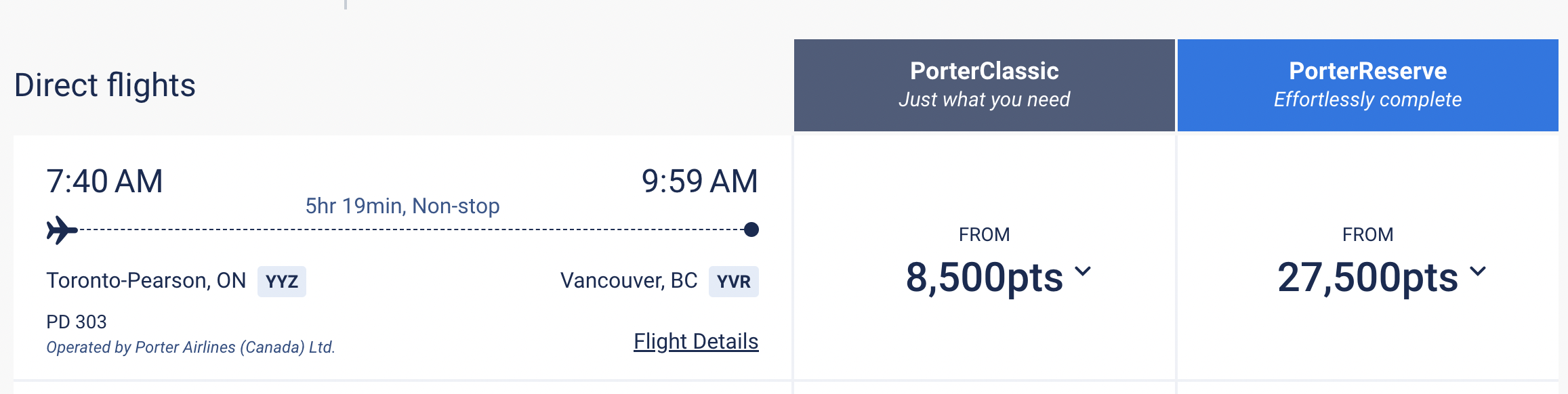

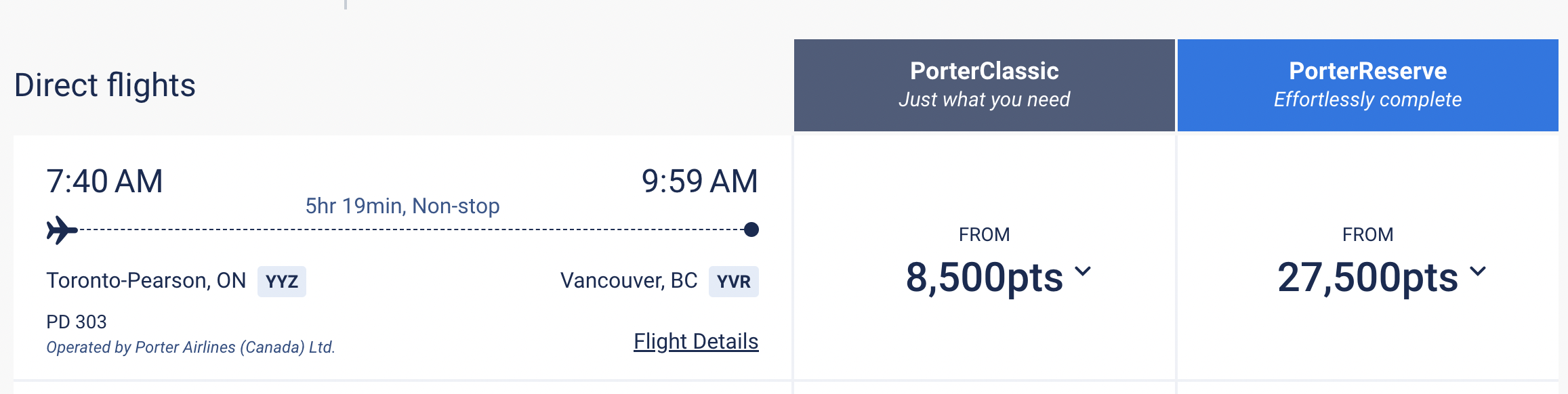

With Porter’s dynamic pricing mannequin, you may count on to pay as little as 5,000–9,000 factors for home one-way flights, which makes this bonus ample for a number of journeys.

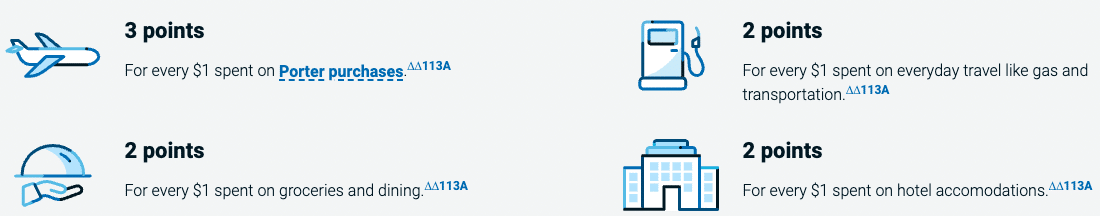

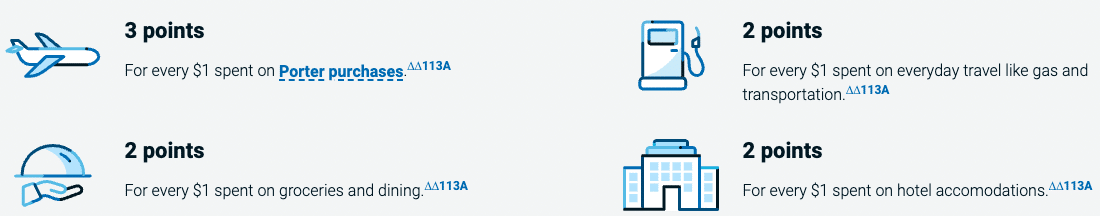

The cardboard’s incomes charges observe a 3-2-1 format throughout the next spending classes, with annual spending caps famous:

- Earn 3 VIPorter factors per greenback spent on as much as $20,000 in Porter purchases yearly†

- Earn 2 VIPorter factors per greenback spent on as much as $5,000 in fuel & transportation purchases yearly†

- Earn 2 VIPorter factors per greenback spent on as much as $10,000 in eating and grocery purchases yearly†

- Earn 2 VIPorter factors per greenback spent on as much as $5,000 in resort purchases yearly†

- Earn 1 VIPorter level per greenback spent on all different eligible purchases†

As soon as once more, utilizing our valuation of VIPorter factors at 1.5 cents per level, you’re taking a look at an efficient return of 1.5–4.5% in your purchases.

Nonetheless, there are many alternatives to spice up that even additional should you’re capable of redeem your VIPorter factors for extra. It’s not unusual to get upwards of three cents per level on redemptions, which might increase your efficient returns accordingly.

Past the accrual of factors via the welcome supply and each day spending, cardholders robotically obtain VIPorter Enterprise Avid Traveller standing, which incorporates the next useful perks:

- Earn 6 VIPorter factors per greenback spent on all Porter Airways purchases (aside from government-imposed taxes and costs)

- Complimentary PorterClassic seat choice (rows 8 and above) for as much as two passengers

- Devoted check-in, precedence safety, and early boarding

- Precedence reaccommodation within the occasion of flight delays

- One complimentary carry-on bag and one complimentary checked bag for your self and as much as eight passengers travelling on the identical reserving

One other standout characteristic on the cardboard is the VIPorter companion go. Spend $9,000 in your first 12 months to earn a round-trip companion go, which provides 100% off the bottom fare for a second passenger.†

In subsequent years, you may earn one other companion go by spending $50,000, which is admittedly a reasonably excessive spending threshold for a companion go within the Canadian market.

An attention-grabbing characteristic is the flexibility to earn all tiers of VIPorter Avid Traveller standing via bank card spending reasonably than flying. You’ll earn $1 in qualifying spend for each $25 spent on the cardboard,† permitting you to succeed in larger standing tiers than the Enterprise standing that comes as a cardholder profit:

- Spending $50,000 would qualify you for VIPorter Passport standing, as you’d have earned $2,000 in Qualifying Spend (although as a cardholder, you’ll already take pleasure in VIPorter Enterprise Avid Traveller standing)

- Spending $75,000 would qualify you for VIPorter Enterprise standing, as you’d have earned $3,000 in Qualifying Spend (although as a cardholder, you’ll already take pleasure in this tier of standing)

- Spending $150,000 would qualify you for VIPorter Ascent standing, as you’d have earned $6,000 in Qualifying Spend

- Spending $250,000 would qualify you for VIPorter First standing, as you’d have earned $10,000 in Qualifying Spend

Lastly, the cardboard comes with a powerful suite of insurance coverage protection, which is outlined intimately on our devoted bank card web page.

As a World Elite®* Mastercard®* product, this bank card has a minimal private annual revenue requirement of $80,000 or a minimal family revenue of $150,000. You’ll additionally should be a Canadian resident and of the age of majority in your province/territory of residence to be eligible.

BMO VIPorter World Elite®* Mastercard®*

- Earn 20,000 VIPorter factors upon spending $5,000 within the first 110 days

- Plus, earn an extra 20,000 VIPorter factors upon spending $9,000 within the first 180 days

- Plus, earn an extra 30,000 VIPorter factors upon spending $18,000 within the first three hundred and sixty five days

- Then, earn 3x VIPorter factors per greenback spent on Porter purchases

- And, earn 2x VIPorter factors per greenback spent on fuel, transportation, eating, groceries, and motels

- Get one free checked bag and one free carry-on bag for your self and as much as eight visitors on the identical reserving

- Precedence airport providers & precedence rebooking within the occasion of delays

- Earn Qualifying Spend in direction of Avid Traveller standing

- Annual charge: $199 (rebated within the first 12 months)

BMO VIPorter Mastercard®*: As much as 40,000 VIPorter Factors

When you don’t meet the minimal revenue requirement for the BMO VIPorter World Elite®* Mastercard®* or should you’re on the lookout for a extra accessible possibility, the BMO VIPorter Mastercard®* provides stable worth with an $89 annual charge (additionally rebated within the first 12 months with the present supply)† and no minimal revenue requirement.†

Plus, the present welcome bonus gives as much as 40,000 VIPorter factors for brand new cardholders,† outlined as follows:

- Earn 10,000 VIPorter factors upon spending $3,000 within the first 110 days†

- Earn an extra 15,000 VIPorter factors upon spending $6,000 within the first 180 days†

- Earn an extra 15,000 VIPorter factors upon spending $10,000 within the first three hundred and sixty five days†

Utilizing our valuation of VIPorter factors at 1.5 cents per level, you’re taking a look at a price of about $600 from the welcome bonus alone, which is great for a card with no minimal revenue requirement.

The incomes charges are extra modest than its World Elite counterpart, and likewise observe a three-tiered construction:

- Earn 2 VIPorter factors per greenback spent on as much as $10,000 in Porter purchases yearly†

- Earn 1 VIPorter level per greenback spent on as much as $3,000 in fuel & transportation purchases yearly†

- Earn 1 VIPorter level per greenback spent on as much as $5,000 in eating and grocery purchases yearly†

- Earn 1 VIPorter level per greenback spent on as much as $3,000 in resort purchases yearly†

- Earn 0.5 VIPorter factors per greenback spent on all different eligible purchases†

As soon as once more, utilizing our valuation of VIPorter factors at 1.5 cents per level, you’re taking a look at an efficient return of 0.75–3% in your each day spending, although the return may very well be larger should you’re capable of redeem your factors for outsized worth.

As a cardholder, you’ll robotically take pleasure in VIPorter Passport Avid Traveller standing, which comes with the next privileges (amongst others):

- Earn 6 VIPorter factors per greenback spent on all Porter Airways purchases (aside from government-imposed taxes and costs)

- Devoted check-in, precedence safety, and early boarding

- Precedence reaccommodation within the occasion of flight delays

In lieu of a VIPorter companion go, you may earn a 35% low cost voucher for as much as 4 passengers after spending $6,000 within the first 12 months.†

Just like the World Elite®* model, this card additionally lets you construct Porter standing via bank card spending:

- Spending $50,000 would qualify you for VIPorter Passport standing, as you’d have earned $2,000 in Qualifying Spend (although as a cardholder, you’ll already take pleasure in VIPorter Passport Avid Traveller standing)

- Spending $75,000 would qualify you for VIPorter Enterprise standing, as you’d have earned $3,000 in Qualifying Spend

- Spending $150,000 would qualify you for VIPorter Ascent standing, as you’d have earned $6,000 in Qualifying Spend

- Spending $250,000 would qualify you for VIPorter First standing, as you’d have earned $10,000 in Qualifying Spend

Lastly, the insurance coverage protection on this card is extra primary, with 8 days of emergency medical protection in comparison with 21 days on the World Elite model. Full particulars of the insurance coverage protection may be discovered on the cardboard’s touchdown web page on our web site.

This bank card has no minimal private annual revenue requirement to be eligible.

BMO VIPorter Mastercard®*

- Earn 10,000 VIPorter factors upon spending $3,000 within the first 110 days

- Plus, earn an extra 15,000 VIPorter factors upon spending $6,000 within the first 180 days

- Plus, earn an extra 15,000 VIPorter factors upon spending $10,000 within the first three hundred and sixty five days

- Then, earn 2x VIPorter factors per greenback spent on Porter purchases

- And, earn 1x VIPorter level per greenback spent on fuel, transportation, eating, groceries, and motels

- Precedence airport providers & precedence rebooking within the occasion of delays

- Earn Qualifying Spend in direction of Avid Traveller standing

- Annual charge: $89 (rebated within the first 12 months)

Conclusion

BMO’s duo of Porter Airways co-branded bank cards supply glorious entry to the VIPorter loyalty program.

With robust welcome bonuses, aggressive incomes charges in key classes, and useful Porter-specific advantages, these playing cards signify stable choices for frequent Porter flyers.

Each playing cards embrace first-year annual charge rebates, making them basically risk-free methods to check drive the Porter ecosystem and increase your factors stability for upcoming journey plans.

† Phrases and circumstances apply. BMO shouldn’t be accountable for sustaining the content material on this web site. Please confer with the BMO web site for probably the most up-to-date data.