What simply occurred? The Trump administration has taken a decisive step in its marketing campaign to limit China’s entry to superior semiconductor know-how, instructing main US firms that produce chip design software program to halt gross sales to Chinese language clients. A number of folks aware of the matter have advised the Monetary Occasions that the US Division of Commerce’s Bureau of Business and Safety lately despatched letters to main digital design automation (EDA) companies – together with Synopsys, Cadence Design Programs, and Siemens EDA – directing them to cease supplying their know-how to the Asian nation.

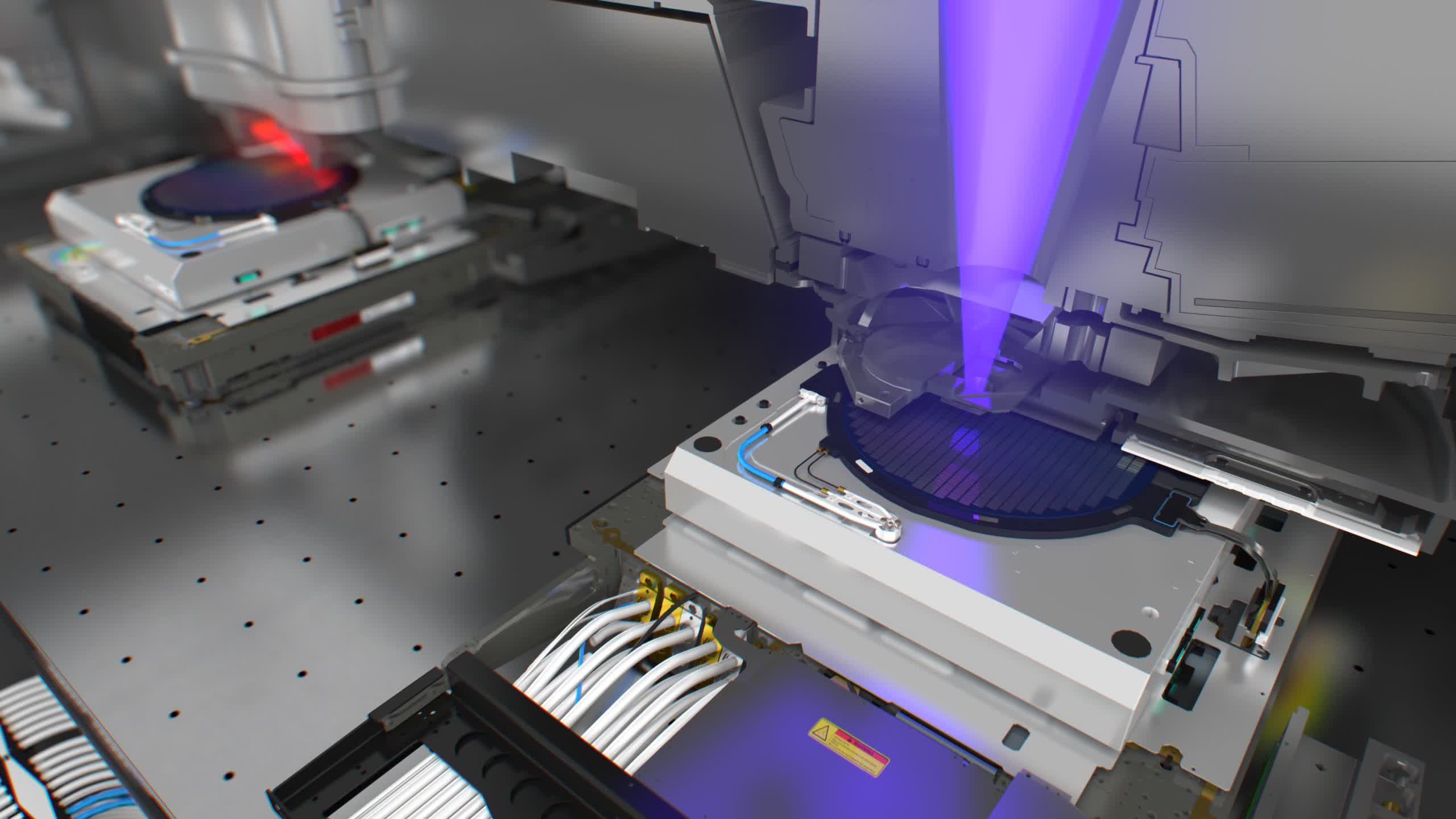

These firms collectively management about 80 p.c of China’s EDA market, making them a vital a part of the worldwide semiconductor provide chain. EDA software program, although a comparatively small section of the business, is crucial for designing and simulating new generations of chips, which underpin developments in synthetic intelligence and different cutting-edge applied sciences.

The transfer comes as Washington intensifies efforts to curb Beijing’s ambitions in synthetic intelligence and superior computing. Earlier this yr, the administration additionally banned Nvidia from promoting its H20 chips to Chinese language purchasers, marking the third spherical of such restrictions since 2022.

A Commerce Division spokesperson advised the FT that the company is “reviewing exports of strategic significance to China” and, in some instances, has “suspended current export licenses or imposed extra licensing necessities whereas the evaluation is pending.”

The influence of those restrictions was instantly felt on Wall Avenue. Shares of Synopsys and Cadence fell sharply, dropping 9.6 p.c and 10.7 p.c, respectively, following experiences of the directive. In fiscal yr 2024, China accounted for roughly 16 p.c of Synopsys’ income – nearly $1 billion – and about 12 p.c of Cadence’s gross sales.

Neither Cadence nor Siemens EDA responded to FT’s requests for remark, whereas Synopsys CEO Sassine Ghazi acknowledged throughout an earnings name, “We’re conscious of the reporting and hypothesis, however Synopsys has not obtained a discover from BIS. So, our steerage that we’re reiterating for the complete yr displays our present understanding of BIS export restrictions, in addition to our expectations for a year-over-year decline in China [revenue].”

The timing of the directive is very delicate, because the US and China are engaged in delicate commerce negotiations. Either side lately agreed to a 90-day pause on new tariffs after talks in Geneva, however the brand new export controls underscore the fragility of this truce.

The broader context for these measures is a deepening technological rivalry between the world’s two largest economies. The US has progressively tightened export controls on semiconductor know-how to take care of its edge and forestall China from creating its superior chips.

In response, China has accelerated its push for self-sufficiency, investing closely in home chipmakers and EDA software program builders. Whereas US and German companies nonetheless dominate the EDA market in China, native opponents akin to Empyrean Expertise, Primarius, and Semitronix have made vital good points, with their shares rising greater than 10 p.c in early buying and selling following the information of the US directive.

The restrictions are already reshaping the semiconductor panorama. US firms face the prospect of diminished revenues and diminished competitiveness on the planet’s largest semiconductor market, whereas Chinese language companies are underneath strain to innovate and substitute international know-how.