The Wealthsimple Visa Infinite* Card is Wealthsimple’s first foray into the bank card house, and like most issues Wealthsimple touches, it’s designed with simplicity in thoughts.

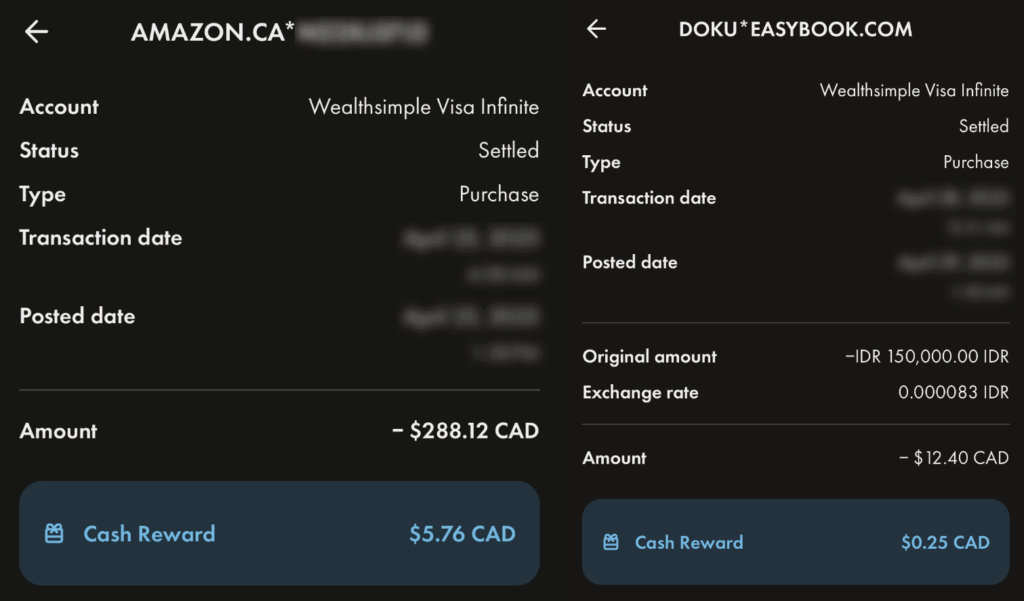

At the moment in beta and out there by invite solely, the cardboard provides a uncommon limitless 2% money again on all purchases and skips the same old 2.5% international transaction charge — making it a standout on paper.

However with no welcome bonus and a stunning lack of journey insurance coverage, this card walks a nice line between promising and untimely.

Let’s break down what this card truly provides, and whether or not it deserves a spot in your pockets.

What we love: Limitless 2% money again with no caps, no international transaction charges`

What we’d change: No journey insurance coverage, no welcome bonus, and restricted to Wealthsimple chequing account for invoice funds.

No Welcome Bonus (For Now)

In contrast to most money again bank cards available on the market, the Wealthsimple Visa Infinite* Card at the moment doesn’t provide any welcome bonus, not even a short lived increase or assertion credit score.

In fact, it’s nonetheless in beta mode and solely out there by invitation to current Wealthsimple shoppers, so it’s doable a welcome provide could also be launched later when the cardboard is launched to the general public.

Nonetheless, it’s onerous to disregard the missed alternative right here. Most competing money again playing cards sweeten the deal for brand spanking new customers.

For instance:

The CIBC Dividend® Visa Infinite* Card provides 10% money again in your first $2,000 in purchases† , plus a first-year annual charge rebate.

The TD Money Again Visa Infinite* Card regularly comes with 10% again on the primary $3,500 in eligible classes†, additionally paired with a first-year charge waiver.

These upfront rewards can simply quantity to $200–350 of worth in your first few months, and that’s earlier than factoring within the different advantages. By comparability, Wealthsimple’s card expenses you $10/month from day one, with no fast return.

Whether or not this modifications sooner or later stays to be seen, however for now, this card doesn’t deliver something further to the desk for brand spanking new candidates.

Limitless 2% Money Again on All the things

The Wealthsimple Visa Infinite* Card retains issues refreshingly easy: you earn 2% money again on all purchases†, with none caps or classes to trace.

This “set-it-and-forget-it” mannequin is uncommon in Canada. Most money again bank cards provide elevated earn charges solely as much as a sure spending threshold, after which the earn charge drops considerably.

To place issues in perspective:

- The TD Money Again Visa Infinite* Card earns 3% on groceries, fuel, and recurring payments, however solely on the primary $15,000 per class every year†. Past that, you’re all the way down to a flat 1%.

- The Scotia Momentum® Visa Infinite* Card earns 4% on groceries and recurring payments, and a pair of% on fuel and transit, however solely on the primary $25,000 in whole spend throughout these classes yearly†.

- The CIBC Dividend® Visa Infinite* Card has a mixed $20,000 cap throughout its 4% and a pair of% bonus classes, and a tough cap of $80,000 in whole annual card purchases†. When you cross that $80,000 threshold, you received’t earn any money again in any respect till the next calendar yr.

In contrast, Wealthsimple’s card has no cap. You’ll earn 2% again whether or not you spend $500 or $50,000 a yr. That’s an edge for anybody who frequently maxes out different playing cards or simply desires an easier resolution with out micro-managing bonus classes.

No International Transaction Charges

One other main win with the Wealthsimple Visa Infinite* Card is the no international transaction charges. Most Canadian bank cards tack on an further 2.5% charge if you spend in international foreign money — a quiet however pricey cost that eats into your rewards.

This makes Wealthsimple’s flat 2% earn charge much more worthwhile when travelling or buying on-line internationally.

For instance, a typical money again card would possibly earn 4% on groceries or eating, however when you issue within the 2.5% FX charge, your web reward drops to round 1.5%, and that’s assuming the acquisition even codes appropriately as a bonus class.

Wealthsimple’s flat and fee-free 2% is a transparent winner right here.

Even playing cards that do waive the FX charge, just like the Scotiabank Passport® Visa Infinite* Card, solely provide 2x Scene+ factors on groceries and eating†. That’s strong, however for all different classes, it drops to only 1x.

In contrast, Wealthsimple earns 2% money again throughout the board, whether or not you’re shopping for souvenirs, reserving excursions, or paying for entry to points of interest.

It’s a easy, dependable card to make use of on any journey, no want to recollect which card to tug out for which class.

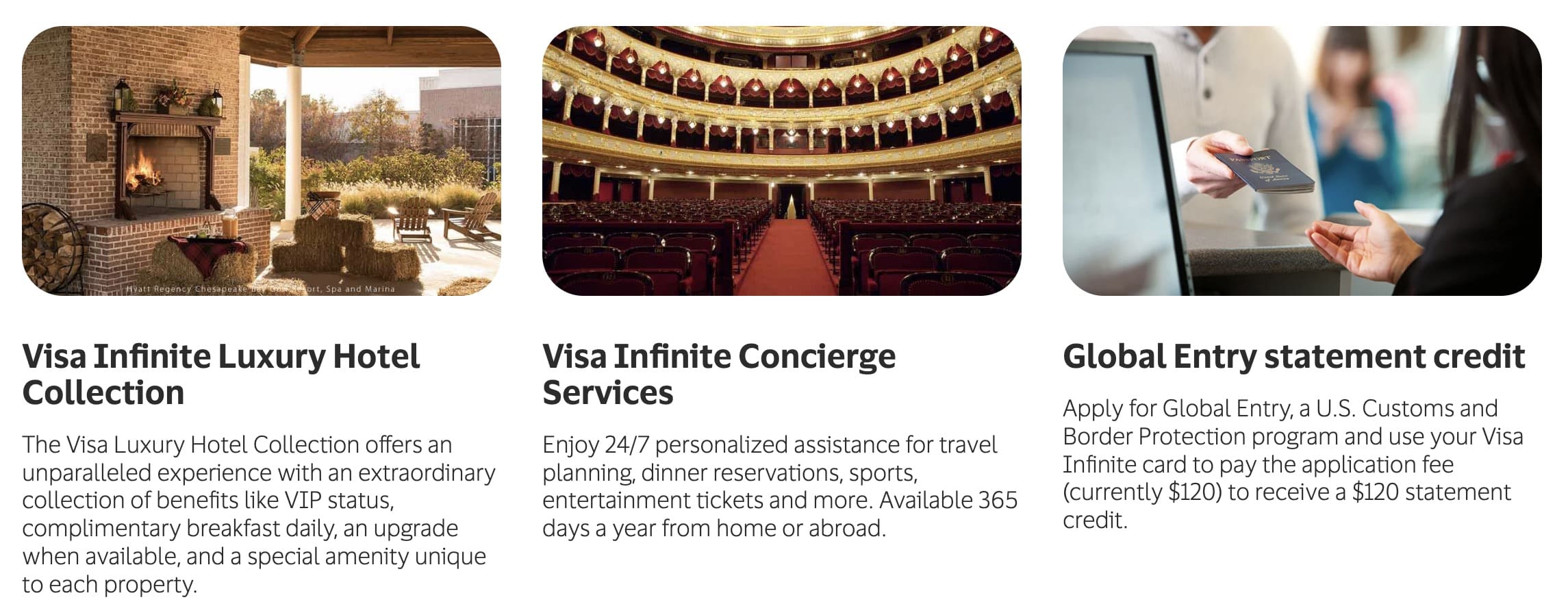

Perks & Visa Infinite Advantages

The Wealthsimple Visa Infinite* Card doesn’t include any flashy perks of its personal. No lounge entry, no journey credit, no roadside help.

As an alternative, the cardboard depends solely on the usual Visa Infinite advantages, which embrace:

- Visa Infinite Concierge

- Visa Infinite Eating and Wine Nation applications

- Entry to the Visa Infinite Luxurious Resort Assortment

These are nice-to-have, however they’re not distinctive to Wealthsimple and practically each Visa Infinite card in Canada provides the identical suite.

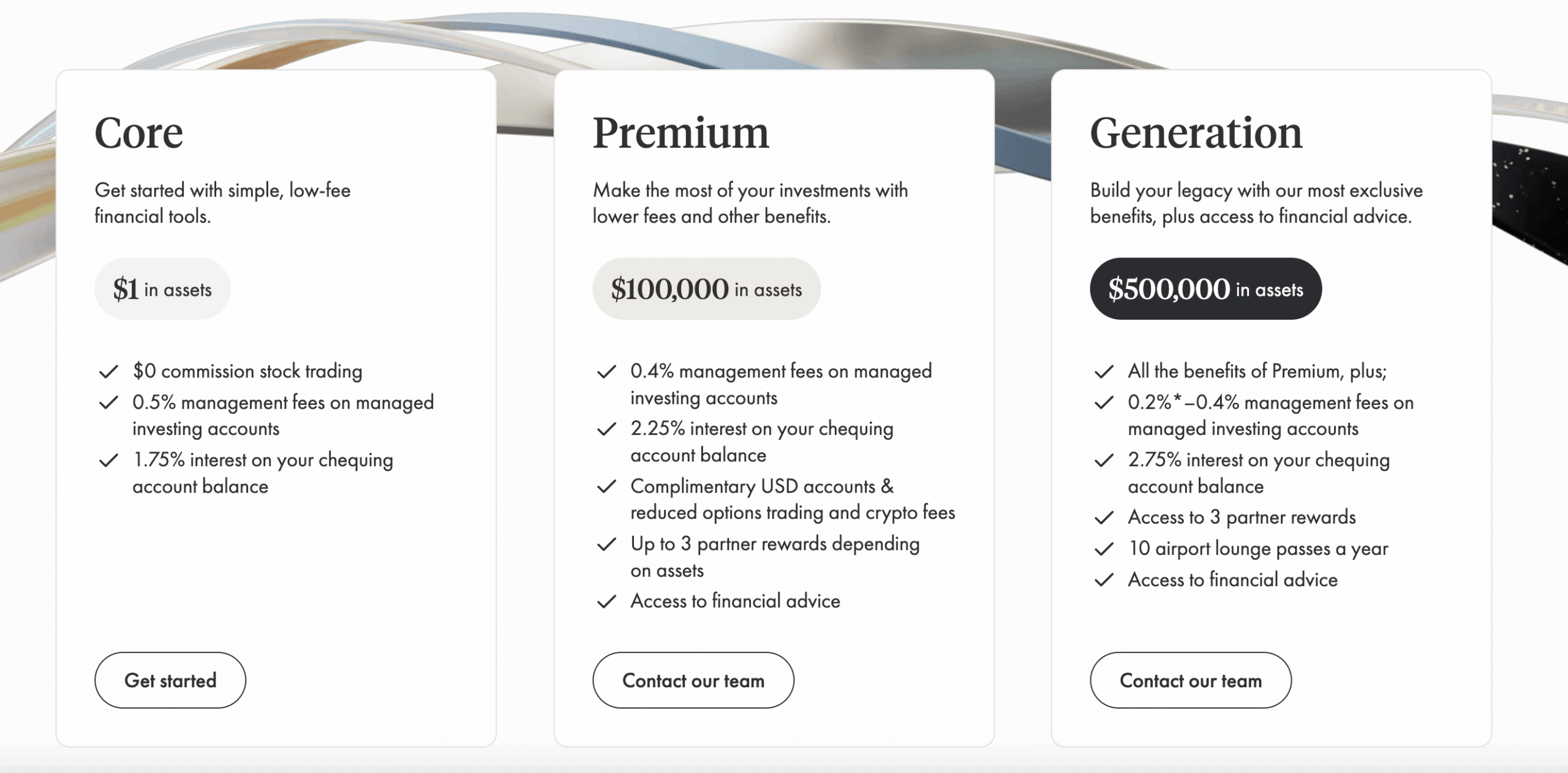

Wealthsimple itself does provide shopper tier advantages based mostly on the dimensions of your funding portfolio, however these aren’t tied to holding the bank card and don’t improve the cardboard expertise straight.

Insurance coverage Protection

For a card with a $120 annual charge and Visa Infinite branding, the insurance coverage protection is underwhelming, particularly for anybody wanting to make use of it as a journey companion.

Right here’s what it contains:

- Cell System Insurance coverage: Covers as much as $1,000 in case your telephone is misplaced, stolen, or by accident broken.

- Buy Safety: Protects new purchases in opposition to loss, theft, or harm for as much as 90 days.

- Prolonged Guarantee: Doubles the producer’s guarantee for eligible gadgets purchased with the cardboard.

That’s it.

What’s noticeably lacking is any kind of journey insurance coverage — no emergency medical protection, journey cancellation, flight delay, rental automotive insurance coverage, or misplaced baggage safety.

These are commonplace on most different Visa Infinite playing cards in Canada, and even some no-fee journey playing cards embrace greater than this.

If you happen to’re a frequent traveller, this card merely doesn’t lower it as your major choice. You’ll have to pair it with one other card that gives the safety you really need on the street.

Evaluate that to a card just like the Nationwide Financial institution® World Elite® Mastercard®, which incorporates complete journey insurance coverage, journey delay, baggage loss, and as much as $5 million in emergency medical protection even for travellers aged 65 and over.

Nationwide Financial institution® World Elite® Mastercard®

- Earn 5x À la carte Rewards factors on grocery and restaurant spend†

- Get journey insurance coverage on award journey, in addition to medical protection on longer journeys for ages as much as 75†

- Obtain $150 in annual credit for airport parking, baggage charges, seat choice charges, lounge entry, and airline ticket upgrades†

- Minimal revenue: $80,000 private or $150,000 family

- Annual charge: $150

Closed Beta + Wealthsimple Ecosystem Necessities

For the time being, the Wealthsimple Visa Infinite* Card is in closed beta, that means it’s solely out there by invitation to a restricted subset of current Wealthsimple shoppers.

If you happen to haven’t been invited, you received’t discover an software hyperlink. And if you happen to reside in Quebec, you’re out of luck for now.

That exclusivity would possibly add some attract, nevertheless it additionally means this card isn’t a viable choice for many Canadians, at the very least not but.

Moreover, you’ll be able to solely pay your card steadiness utilizing a Wealthsimple Chequing account. Realistically, you doubtless received’t even obtain an invitation until you have already got one.

As soon as the product formally launches, it’s doable that funds from exterior banks could also be allowed. However for now, this appears like a wise technique to encourage clients to carry extra of their money and property inside the Wealthsimple ecosystem.

On the flip facet, the Wealthsimple Money Mastercard, which is linked to the Wealthsimple Chequing account, is definitely a nice no-FX-fee pay as you go card for spending and withdrawing international foreign money at ATMs overseas.

If you happen to’re already utilizing it for journey or on a regular basis spending, this received’t really feel like a lot of a hurdle.

Different Playing cards to Think about

The Wealthsimple Visa Infinite* Card stands out for its limitless 2% money again and no international transaction charges, nevertheless it’s not the one choice on the market, particularly if you’d like broader perks or higher journey protection.

Listed here are two sturdy options:

Scotiabank Passport® Visa Infinite* Card

This card additionally has no FX charges, however comes with six free airport lounge visits per yr, full journey insurance coverage, and earns 2x Scene+ factors per greenback spent on groceries, eating, and leisure.

Nonetheless, it solely earns 1x on the whole lot else, so you might not earn as a lot general in case your spending is extra common.

Scotiabank Passport® Visa Infinite* Card

- Earn 30,000 Scene+ factors upon spending $2,000 within the first three months

- Earn an extra 10,000 Scene+ factors upon spending $40,000 within the first yr

- Earn 2x Scene+ factors on groceries, eating, leisure, and transit

- Plus, earn 3x Scene+ factors on grocery purchases at Sobeys, IGA, Safeway, and FreshCo

- Visa Airport Companion membership with six free lounge visits per yr

- Redeem factors for assertion credit score for any journey expense

- Minimal revenue: $60,000 private or $100,000 family

- Annual charge: $150

Scotiabank Gold American Categorical® Card

One other no-FX-fee card, with as much as 6x Scene+ factors per greenback spent on groceries, eating places, and meals supply, plus strong journey insurance coverage.

Simply observe that Amex acceptance will be hit-or-miss overseas, and non-bonus classes solely earn 1x.

Scotiabank Gold American Categorical® Card

- Earn 20,000 Scene+ factors upon spending $2,000 within the first three months

- Plus, earn an further 20,000 Scene+ factors upon spending $7,500 within the first yr

- Earn 6x Scene+ factors at Sobeys, IGA, Safeway, FreshCo, and extra

- Plus, earn 5x Scene+ factors on groceries, eating, and leisure

- Additionally, earn 3x Scene+ factors on fuel, transit, and choose streaming companies

- Redeem factors for a press release credit score for any journey expense

- No international transaction charges

- Benefit from the unique advantages of being an American Categorical cardholder

- Annual charge: $120

By comparability, the Wealthsimple Visa Infinite* Card earns a flat 2% in all places.

Whether or not you’re reserving flights or shopping for bottled water in Europe. It’s this simplicity, paired with no FX charges, that offers it a quiet edge for constant earners even when it lacks the bells and whistles.

Conclusion

The Wealthsimple Visa Infinite* Card brings a refreshing simplicity to the Canadian bank card market, providing limitless 2% money again on all purchases and no international transaction charges, two options which might be hardly ever seen collectively.

It’s an particularly compelling choice for prime spenders, frequent travellers, or anybody uninterested in juggling rotating bonus classes and FX surcharges.

And if you happen to’re already utilizing Wealthsimple for investing or on a regular basis banking, the ecosystem tie-in might really feel like a pure extension.

However the card isn’t with out its caveats. With no welcome bonus, no journey insurance coverage, and closed beta entry restricted to Wealthsimple shoppers, this isn’t the form of card that’s prepared for prime time, simply but.

If and when the cardboard opens to the general public, it might develop into a severe contender within the money again house.

Till then, it’s a promising product, however one which’s greatest considered as a complement to, fairly than a alternative for, a full-featured journey bank card.

† Phrases and circumstances apply. Please confer with Wealthsimple’s web site for probably the most up-to-date product info.