Carrying a thick stack of money or scouring the streets for a obscure foreign money trade sales space is the sort of journey tip you’d anticipate finding in a historical past guide.

Nowadays, good travellers can skip the effort and the horrible charges by utilizing pay as you go playing cards that waive international transaction charges and work seamlessly at ATMs overseas.

Even higher, these playing cards assist Canadians dodge a typical however lesser-known lure: double foreign money conversion.

When exchanging Canadian {dollars} right into a non-USD foreign money like Korean received or Mexican pesos, many banks and cubicles convert your funds to USD first, then to the vacation spot foreign money, charging you a markup at each steps.

And when withdrawing from an ATM, there’s yet one more trick to be careful for: Dynamic Foreign money Conversion (DCC). It quietly inflates the trade price if you select to be charged in your house foreign money as an alternative of the native one.

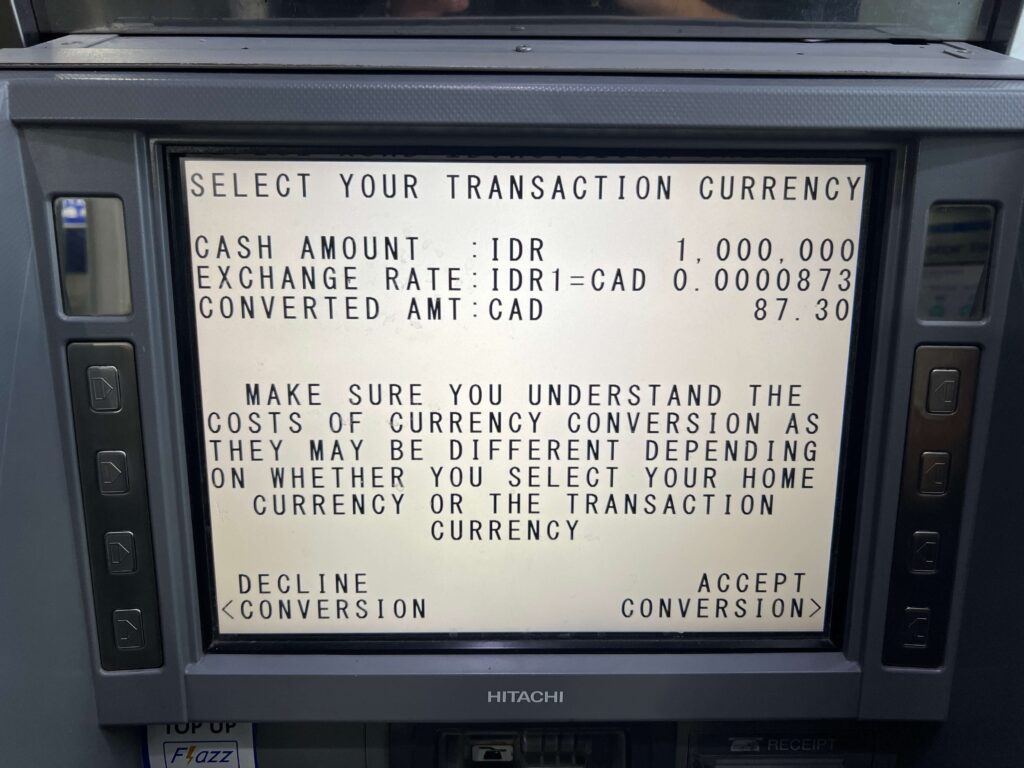

Right here’s what that lure appears to be like like in actual life:

On this instance, the ATM provides to transform 1,000,000 IDR at a price of 0.0000873, leading to a cost of $87.30 CAD. However on the time, the mid-market price was nearer to 0.000084—about $84 CAD. That’s a $3+ distinction for no cause in any respect.

Earlier than we dive into the most effective pay as you go playing cards for journey, let’s take a fast take a look at how they work and why they’re such a useful gizmo for managing your cash overseas.

What Is a Pay as you go Credit score Card?

At their core, pay as you go bank cards work like a hybrid between a debit card and a bank card. You load funds onto the cardboard upfront, normally by way of Interac e-Switch, debit card, invoice fee, or direct deposit, after which spend from that steadiness.

Not like a standard bank card, you’re not borrowing cash. And in contrast to most chequing accounts, there are usually any month-to-month charges or minimal steadiness necessities.

Higher but, getting one doesn’t contain a onerous credit score test (so long as you decide out of the overdraft characteristic), and also you received’t unintentionally rack up curiosity costs, because you’re solely spending what you’ve already loaded.

Pay as you go playing cards are nonetheless a part of the Visa or Mastercard community, which implies they’re accepted virtually wherever a daily bank card is—each on-line and in individual.

That makes them particularly helpful for journey, the place you may want a card for resort holds, on-line bookings, and even simply faucet funds overseas.

They’re additionally an amazing choice for college students or newcomers to Canada who don’t but have entry to conventional credit score. Whereas some resorts or automobile rental firms might insist on a full bank card, many will settle for a pay as you go card if it has sufficient steadiness to cowl the deposit—making it a sensible workaround in conditions the place you’d in any other case be caught.

And whereas many Canadians use pay as you go playing cards as a budgeting software (because of smooth apps and on the spot transaction monitoring), additionally they serve a really particular goal for travellers: they allow you to withdraw money at international ATMs with out triggering the standard money advance charges or international trade markups that bank cards like to sneak in.

Examine the Greatest Pay as you go Playing cards for Canadian Travellers

With so many choices out there, choosing the proper pay as you go card is dependent upon your journey habits, spending fashion, and want for simplicity or flexibility.

Right here’s a side-by-side take a look at the highest no-FX-fee pay as you go playing cards for Canadians in 2025, highlighting their strengths, limitations, and best use instances.

Wealthsimple Pay as you go Mastercard: Smooth, Easy, and No FX Charges

If you happen to’re searching for essentially the most well-rounded pay as you go card to take in your travels, the Wealthsimple Pay as you go Mastercard is the one to beat.

It hits all the suitable notes: no charges of any sort, no international transaction charges, and no ATM withdrawal charges—a uncommon trifecta that makes it a standout for Canadians heading overseas.

Whether or not you’re travelling for per week or a couple of months, this card provides a fuss-free expertise with surprisingly stable options:

Whether or not you’re travelling for per week or a couple of months, this card provides a fuss-free expertise with surprisingly stable options:

- 1% money again on each buy, which you’ll be able to select to direct into money, shares, or crypto holdings (notice that the latter two choices have tax implications in the event that they rise in worth, so money again could also be preferable for a common person)

- No international trade charges – a uncommon sight within the Canadian market

- No ATM withdrawal charges – apart from charges imposed by the ATM operator (many ATMs worldwide don’t cost a payment); Wealthsimple additionally reimburses as much as $5 per transaction for home ATM charges in Canada (credited inside 3–4 enterprise days)

- Beneficiant ATM withdrawal limits – as much as $3,000 per day and $10,000 per week

- No month-to-month or annual charges

- Ship/obtain Interac e-Transfers with no charges (quick and as much as $5,000 per switch)

- Masses simply by way of Interac e-Switch, debit card, exterior financial institution switch, or direct deposit

- Funds are CDIC insured as much as $100,000

- Absolutely appropriate with Apple Pay and Google Pay

You don’t simply need to take my phrase for it, right here’s a real-world instance.

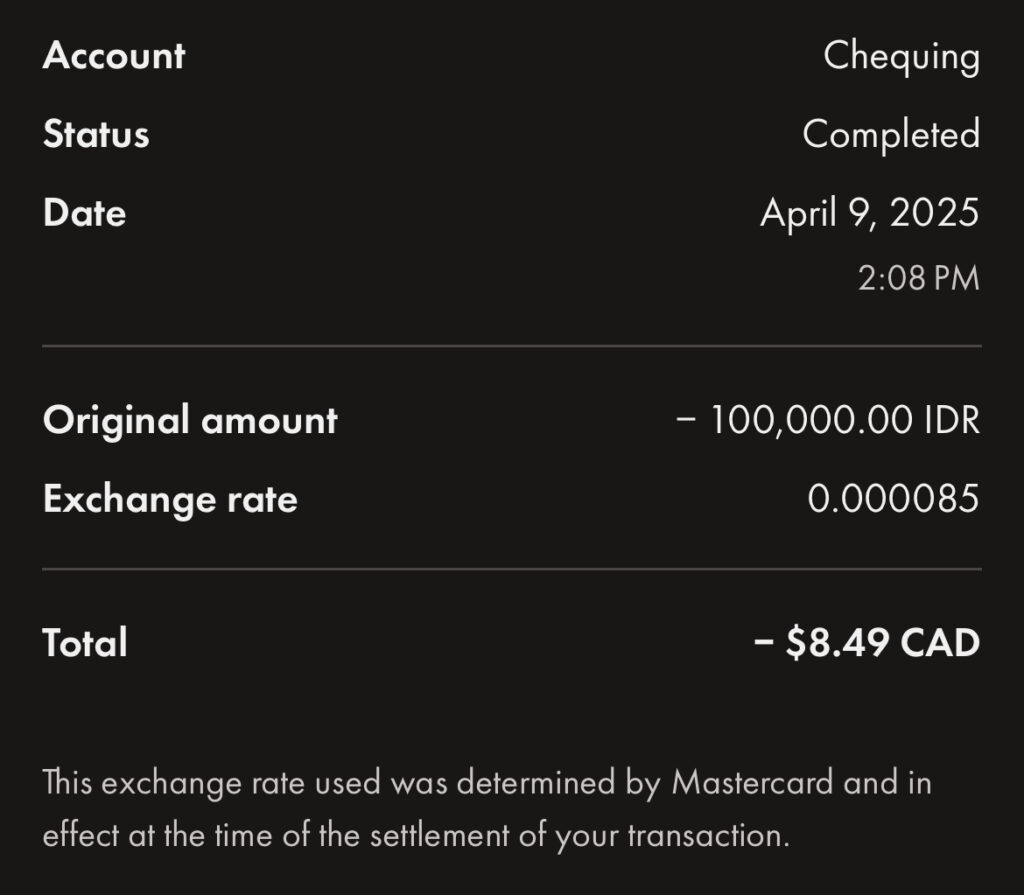

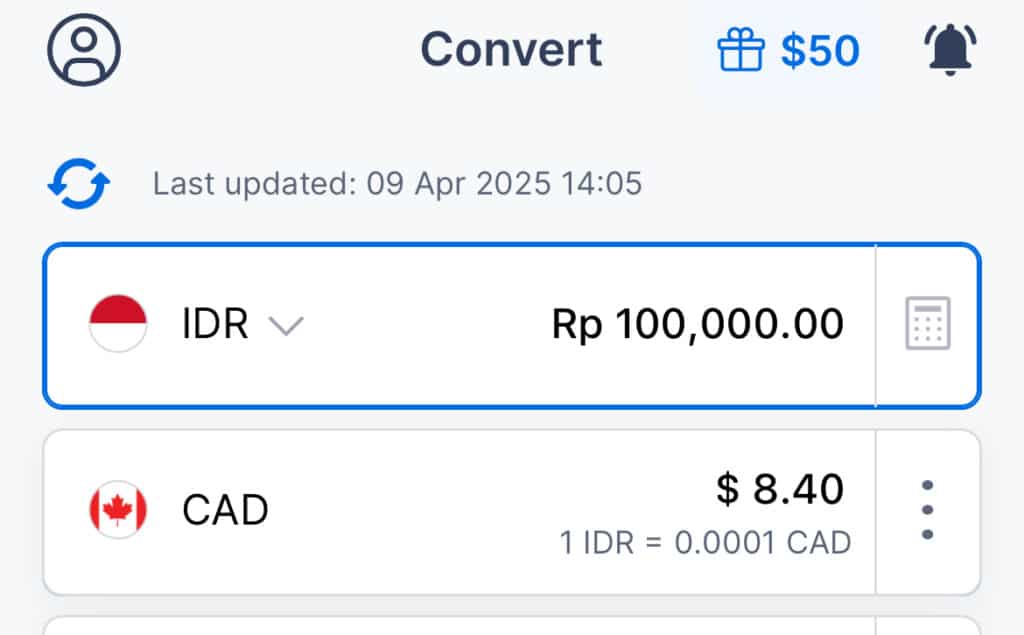

On April 9, 2025, I withdrew 100,000 Indonesian Rupiah (IDR) utilizing my Wealthsimple Pay as you go Mastercard. The cardboard charged me $8.49 CAD, whereas the mid-market price on the time (in keeping with XE Foreign money) would have transformed the identical quantity to $8.40 CAD.

The Mastercard trade price used was 0.000085, whereas the mid-market price was 0.000084. In different phrases, the speed I obtained was basically at spot, with no added FX markup or withdrawal payment from Wealthsimple.

This confirms that you just’re getting very aggressive conversion charges when utilizing Wealthsimple overseas, and it’s an amazing instance of why this card stands out for worldwide use.

The app can be smooth and beginner-friendly, and the bodily card comes with a clear black-and-gold design that feels extra premium than you’d count on from a pay as you go product.

Personally, I’m a giant fan of what the Wealthsimple Pay as you go Mastercard at the moment provides. It feels virtually too good to be true in as we speak’s market, and I actually hope this isn’t only a buyer acquisition technique that results in nerfs down the highway.

If it stays this sturdy, it’ll proceed to be top-of-the-line pay as you go playing cards Canadians can carry whereas travelling.

Wealthsimple additionally provides further advantages based mostly in your property underneath administration, with three tiers: Core, Premium, and Era. You solely want $1 in property to qualify for the Core tier, which already contains all the important thing options listed above.

Premium and Era tiers, unlocked with $100,000 and $500,000 in property respectively, provide greater rates of interest, precedence service, and added companion perks like airport lounge passes, however you don’t want these to learn from the travel-friendly core options.

One factor to bear in mind is that Wealthsimple blocks transactions and ATM withdrawals within the following international locations resulting from sanctions or inside coverage:

Afghanistan, Bangladesh, Belarus, Central African Republic, Congo, Cuba, Democratic Republic of Congo, Eritrea, Ethiopia, Guinea-Bissau, Haiti, Iran, Iraq, Kosovo, Liberia, Libya, Mali, Myanmar, North Korea, Russia, São Tomé and Príncipe, Sierra Leone, Somalia, South Sudan, Sudan, Syria, Ukraine, Venezuela, and Yemen.

Be sure you test the official record earlier than making journey plans.

With beneficiant limits, a smooth app, and nil charges even on the base tier, the Wealthsimple Pay as you go Mastercard earns its spot as my prime suggestion for pay as you go journey playing cards in Canada.

EQ Financial institution Card: Charge-Free Performance with a Few Frictions

The EQ Financial institution Card is a sensible and reliable pay as you go choice for Canadians who wish to keep away from international transaction charges with out giving up the total performance of a standard checking account.

Whereas it might not be the flashiest card on the market, it provides a compelling mixture of options—particularly should you worth flexibility, safety, and curiosity in your steadiness.

Right here’s what makes the EQ Financial institution Card a stable journey companion:

- No international transaction charges

- No month-to-month or annual charges

- No EQ-imposed ATM withdrawal charges (solely operator charges might apply)

- Automated reimbursement of home ATM charges (as much as any quantity)

- Earn curiosity in your steadiness – at the moment 1.25%, with promotions of as much as 4% if you arrange direct deposit of $2,000+ monthly

- 0.5% money again on purchases

- Masses simply out of your EQ Financial institution financial savings account (which helps Interac e-Switch, invoice funds, and direct deposit)

- Absolutely appropriate with Apple Pay and Google Pay

- Contains full checking account options, together with cheque deposits, invoice pay, and extra

A key distinction with EQ Financial institution is the way it handles your funds: your principal steadiness sits in a high-interest financial savings account, and you will need to manually switch cash to your card steadiness with the intention to spend or withdraw it.

Whereas this provides a layer of management and acts as a useful security buffer in case your card is misplaced or stolen, it might really feel inconvenient should you’re making an attempt to make a fast buy or seize money on the fly.

One other key limitation to concentrate on: the EQ Financial institution Card doesn’t help Mastercard 3D Safe transactions. As extra retailers undertake this safety protocol, some on-line purchases could also be mechanically declined. If you happen to often store on-line, this might develop into a recurring inconvenience.

Moreover, the EQ Financial institution app typically feels gradual and dated. Whereas practical, the app feels noticeably slower in comparison with extra trendy fintech platforms.

That stated, EQ Financial institution is a Schedule I Canadian financial institution, that means your deposits are CDIC insured as much as $100,000, providing peace of thoughts whereas travelling or storing greater balances.

If you happen to don’t thoughts the guide transfers and occasional app lag, the EQ Financial institution Card delivers significant worth for Canadian travellers, notably those that admire a no-fee setup and interest-bearing steadiness.

Backside line: Wealthsimple wins for pure comfort, whereas EQ Financial institution wins for old-school management and safety.

Clever Card: A Area of interest however Highly effective Backup for Journey

Thirdly, we have now the Clever Card, which isn’t fairly as sturdy as the previous two choices—however nonetheless performs an vital function for travellers who want flexibility.

Processed by Visa, the Clever Card can function an amazing backup, particularly in conditions the place a service provider or ATM solely accepts Visa relatively than Mastercard.

It makes use of the true mid-market trade price for foreign money conversions, a a lot better deal in comparison with the standard 2.5% international transaction payment charged by most Canadian banks.

Higher but, Clever shows all charges transparently and even compares their charges towards conventional banks in actual time. I really admire this method and actually want extra monetary establishments would undertake this stage of transparency as a typical characteristic.

Earlier than the launch of the Clever Card, Clever primarily centered on serving to customers trade currencies at higher charges than massive banks, and this legacy exhibits.

It provides a novel characteristic not discovered on most different pay as you go playing cards: the flexibility to maintain, spend, and ship foreign currency echange on to native financial institution accounts abroad.

This is usually a large benefit if you wish to convert your cash upfront.

For instance, should you’re planning a visit to Türkiye and the Turkish Lira is at the moment undervalued towards the Canadian greenback, you possibly can proactively convert your funds to TRY, lock within the price, and maintain onto it till your travels.

Right here’s a fast overview of what the Clever Card provides:

- Entry to 50+ currencies to carry, convert, and spend

- Actual mid-market trade charges with low clear conversion charges (~0.35–1%)

- Visa community acceptance worldwide

- Capacity to ship cash on to international financial institution accounts

- Absolutely compatibale with Apple Pay and Google Pay

- No hidden charges, with real-time comparisons towards banks

Nevertheless, it’s not all easy crusing.

Whereas Clever technically advertises free ATM withdrawals, the fact is extra restrictive: you’re restricted to $350 throughout two withdrawals monthly, after which charges kick in.

Past that, Clever costs a $1.50 flat payment + 1.75% of the withdrawal quantity. A payment construction that feels unusually punitive in comparison with the opposite pay as you go playing cards we’ve lined.

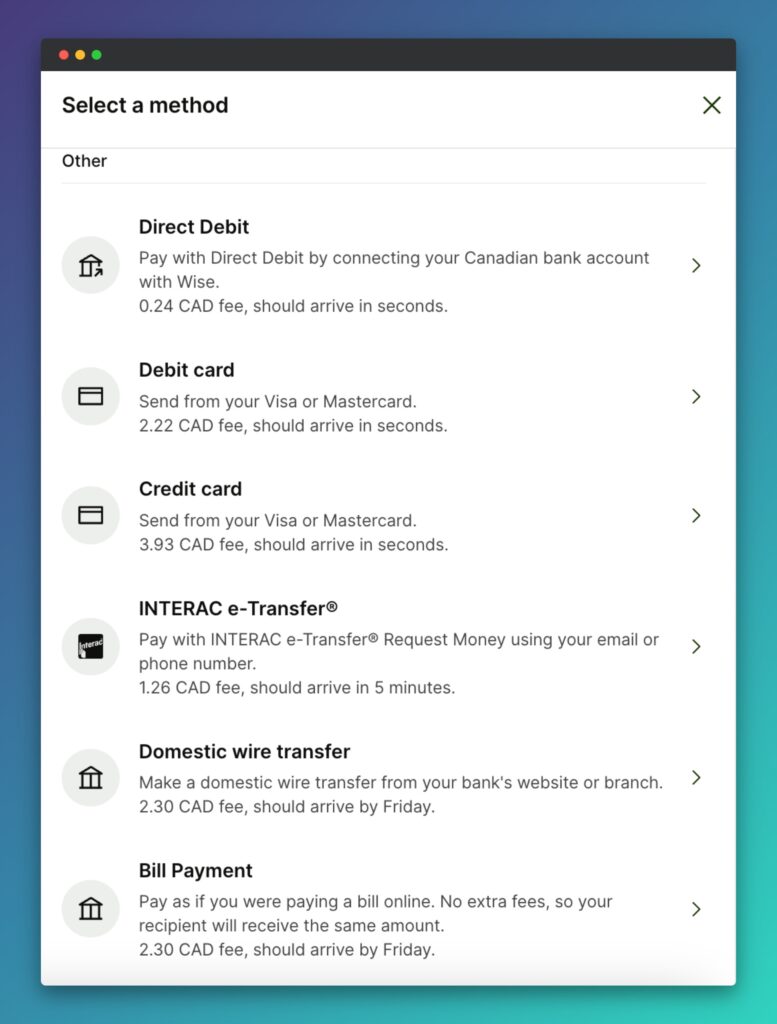

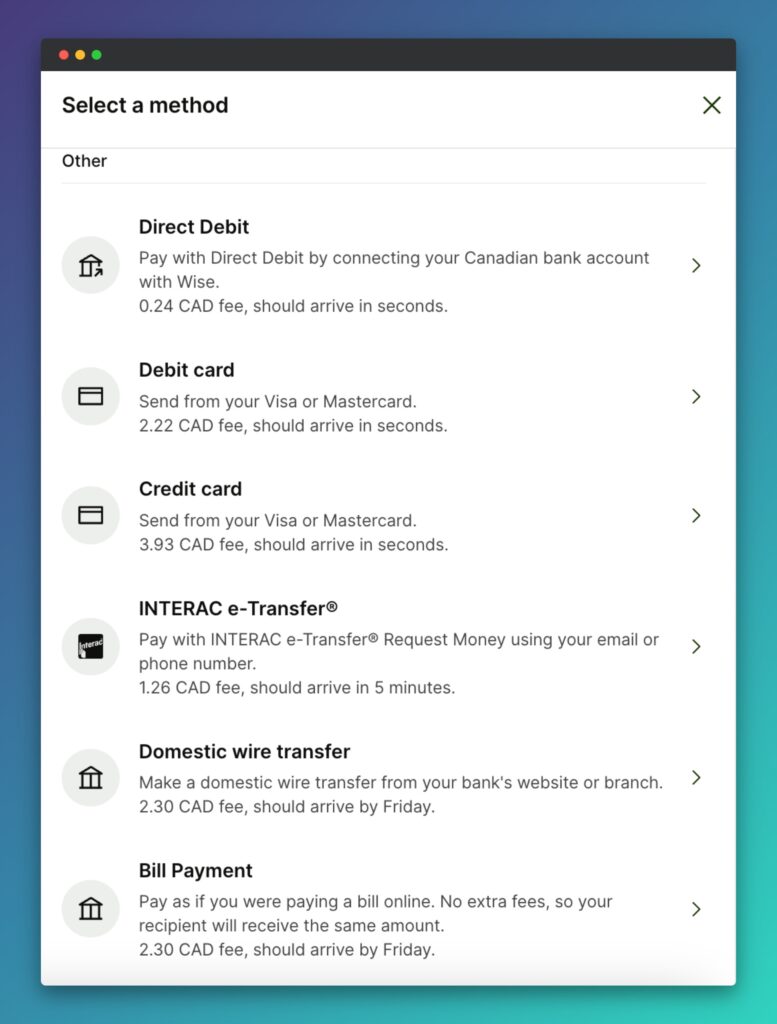

One other important level: including funds to your Clever account may also be deceptively difficult. When topping up, you received’t discover an apparent free loading choice.

Nevertheless, there’s a hidden methodology: by establishing auto-deposit utilizing your Clever login electronic mail, you possibly can ship an Interac e-Switch to your Clever account without cost. It really works completely, however Clever doesn’t precisely shout this from the rooftops.

A recurring theme on the earth of pay as you go playing cards is that the merchandise, together with the Clever Card, are accessed primarily by way of apps. Clever additionally has wonderful performance on its desktop website, not like a number of the different choices on its app.

Total, it’s no secret that Clever provides a mess of capabilities, but it surely’s undoubtedly a double-edged sword. Whereas the flexibleness and foreign money management are unbelievable for energy customers, the system is advanced sufficient that the common person may face a steep studying curve to totally maximize all the advantages.

If you happen to’re prepared to place within the effort, the Clever Card may be an extremely helpful backup software to pair with a extra easy main pay as you go card.

PC Cash Account: Now FX-Pleasant, However Nonetheless Higher for Native Use

The PC Cash Account has quietly develop into a extra viable choice for travellers, because of a current replace that eliminated international transaction charges.

Whereas it’s nonetheless not as feature-rich as different playing cards on this record, it earns a spot as a stable no-fee backup, notably should you already store inside the PC Optimum ecosystem.

Issued by PC Monetary and powered by the Mastercard community, the cardboard acts as a hybrid pay as you go account and chequing various, with reward-earning potential and full cellular pockets help.

Right here’s what you get with the PC Cash Account:

- No month-to-month or annual charges

- No international transaction charges

- $1.50 payment for home ATM withdrawals exterior PC Monetary ATMs

- $3.00 payment for worldwide ATM withdrawals

- Earn 10 PC Optimum factors per greenback spent at Loblaw banner shops

- Earn 5 PC Optimum factors per greenback spent on all different purchases

- Free Interac e-Transfers

- Apple Pay and Google Pay appropriate

Whereas the 1% earn price at Loblaw shops is enticing, the bottom 0.5% earn price elsewhere isn’t notably aggressive in comparison with another pay as you go or cashback playing cards. And though international transaction charges have been eradicated, the flat ATM charges ($3 internationally) can nonetheless add up should you’re withdrawing money often overseas.

That stated, there’s one other sweetener: PC Monetary additionally sometimes runs bonus factors promotions at Loblaw banner shops if you pay with a PC Monetary product, together with the PC Cash Account. These promotions can provide a simple option to enhance your Optimum factors steadiness even quicker should you frequently store at affiliated shops.

Due to no FX charges, free e-Transfers, and robust grocery integration, the PC Cash Account is now rather more traveller-friendly than it was once. It’s nonetheless finest suited to home on a regular basis use, however it might additionally function a helpful backup for infrequent journey or on-line spending, particularly for these already invested within the PC Optimum program.

Conclusion

Pay as you go playing cards have come a good distance from being area of interest budgeting instruments to changing into genuinely helpful companions for travellers. Whether or not you’re trying to dodge international transaction charges, withdraw native foreign money with out money advance costs, or just keep away from the danger of carrying a bank card, there’s a pay as you go choice that matches the invoice.

For many Canadians, the Wealthsimple Pay as you go Mastercard stands out as the most effective all-around alternative—it’s easy, fee-free, and rewarding.

EQ Financial institution provides a layer of management and financial savings account integration, whereas Clever provides unmatched flexibility for multi-currency travellers, albeit with a steeper studying curve.

In the meantime, the PC Cash Account has develop into a surprisingly first rate backup card, particularly for PC Optimum fanatics and home customers.

Every card has its personal strengths and trade-offs, however the important thing takeaway is that this: you now not have to depend on money exchanges or bank card charges when travelling. With the suitable pay as you go card (or combo of two), you possibly can hold issues safe, easy and cost-effective