TD Canada Belief affords Canadians a easy solution to earn Aeroplan factors immediately via its lineup of Aeroplan co-branded bank cards.

Whether or not you’re new to the world of factors or simply trying to stage up your on a regular basis spending, TD’s suite of Aeroplan playing cards is likely one of the most accessible entry factors into this system.

At present, TD affords three private Aeroplan bank cards, every with its personal mixture of earn charges, advantages, and journey perks. (There’s additionally a enterprise model, however we’ll save that for an additional day.)

On this put up, we’ll stroll you thru the private playing cards, spotlight what makes them value having, and present you learn how to redeem Aeroplan factors for optimum worth.

What Is Air Canada Aeroplan?

Aeroplan is the loyalty program for Air Canada, Canada’s flagship airline.

Aeroplan is broadly thought-about essentially the most priceless loyalty program within the Canadian Miles & Factors panorama due to its utility and worth, its glorious partnerships with different airways, and the benefit of incomes factors in Canada.

Aeroplan factors might be redeemed for some really unimaginable flight experiences, corresponding to absolutely lie-flat enterprise class seats and multi-city journeys utilizing Aeroplan’s beneficiant stopover coverage.

TD’s suite of Aeroplan co-branded bank cards supply a wonderful solution to interact with Aeroplan, and so they permit cardholders to earn factors on on a regular basis spending and thru welcome bonuses.

Moreover, Aeroplan bank card holders can take pleasure in Air Canada perks and advantages to additional enhance their journey experiences.

In Canada, Aeroplan factors might be earned in some ways, together with via spending on co-branded bank cards, by making purchases via the Aeroplan eStore, and with quite a lot of on a regular basis companions corresponding to Uber/Uber Eats, Starbucks, LCBO, Journie, and extra.

Aeroplan factors can be earned by transferring Membership Rewards factors from an American Categorical account. Membership Rewards factors switch to Aeroplan at a charge of 1:1.

When you’ve collected some Aeroplan factors, you’ll be able to redeem them in quite a lot of methods, together with for flights, lodge bookings, merchandise, present playing cards, and extra.

Of the above redemption choices, essentially the most priceless solution to redeem your factors (by far) is for flights booked via the Aeroplan portal.

In a later part, we’ll go over this selection intimately; nevertheless, should you’d wish to be taught extra concerning the different redemption choices, you’ll be able to take a look at our Important Information to Aeroplan.

TD Aeroplan Credit score Playing cards

As talked about above, TD at the moment affords three private Aeroplan co-branded bank cards: TD® Aeroplan® Visa Infinite Privilege* Card, TD® Aeroplan® Visa Infinite* Card, and the TD® Aeroplan® Platinum Visa* Card.

Right here’s a side-by-side comparability that will help you determine at a look.

TD® Aeroplan® Visa Infinite Privilege*

The TD® Aeroplan® Visa Infinite Privilege* Card is TD’s premium Aeroplan bank card, offering cardholders with one of the best incomes charges, essentially the most important welcome bonus, and one of the best Air Canada perks.

The cardboard’s welcome bonus fluctuates relying on the financial institution’s present supply and has traditionally fallen between 80,000 and 115,000 Aeroplan factors.

As with every bank card providing a welcome bonus, it’s greatest to use for the cardboard when there may be an elevated supply because the bonus is simply legitimate for first-time cardholders.

The charges and eligibility necessities for this card are as follows:

- Annual charge: $599 (all figures in CAD)

- Supplementary cardholders: $199

- Minimal revenue requirement: $150,000 (private), $200,000 (family)

- Estimated credit score rating wanted: Good to Glorious

The incomes charges for the TD® Aeroplan® Visa Infinite Privilege* Card are barely elevated in comparison with its mid-tier counterpart, the TD® Aeroplan® Visa Infinite* Card, with cardholders having fun with 0.25–0.5 extra Aeroplan factors in a few the incomes classes.

The incomes charges for the TD® Aeroplan® Visa Infinite Privilege are as follows:

- 2 Aeroplan factors† per greenback spent on eligible Air Canada® purchases, together with Air Canada Holidays®†

- 1.5 Aeroplan factors† per greenback spent on eligible groceries, gasoline, eating, meals supply, and journey†

- 1.25 Aeroplan factors† per greenback spent on the whole lot else†

For example of the incomes energy of those charges, let’s think about that you simply spend $1,000 monthly on gasoline and groceries, incomes 1.5 Aeroplan factors per greenback spent.

With this quantity of spending, over the course a yr, you’ll earn 18,000 Aeroplan factors ($1,000 x 1.5 earn charge = 1,500 factors x 12 months = 18,000 factors).

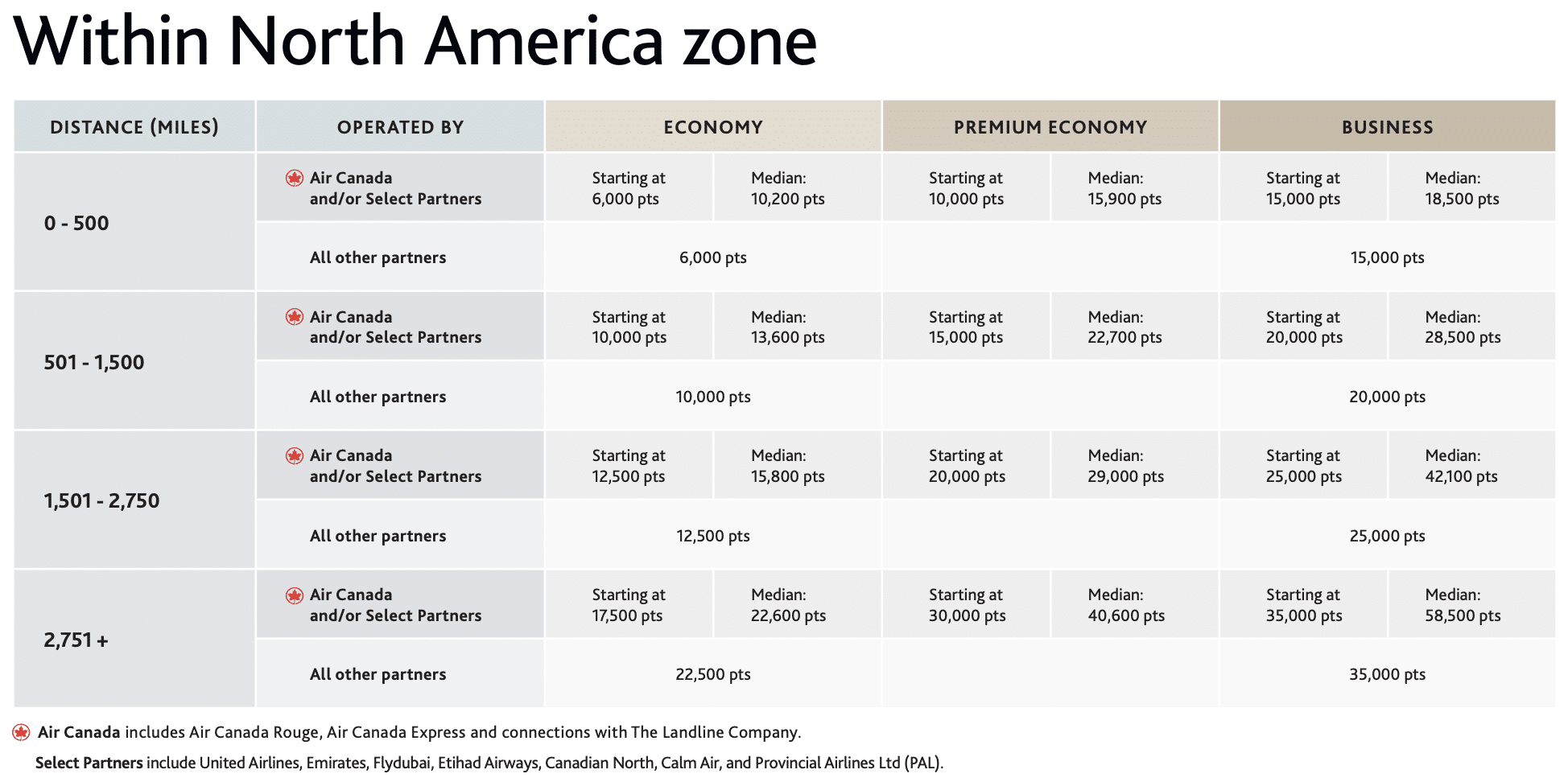

Based mostly on Aeroplan’s redemption chart beneath, 18,000 factors can be utilized for a number of completely different redemptions.

For instance, it’s typically sufficient to e-book a one-way financial system flight from Toronto (YYZ) to Vancouver (YVR) or maybe a one-way enterprise class flight from Vancouver (YVR) to Los Angeles (LAX) on a companion airline.

Take into account that Air Canada’s redemptions are priced dynamically so the precise costs can find yourself being significantly larger when there’s a giant demand for a selected flight/seat.

The TD® Aeroplan® Visa Infinite Privilege* card additionally comes with an array of journey perks and advantages.

These advantages embrace precedence boarding and check-in, and a free first checked bag on all Air Canada® flights†, airport lounge entry at Air Canada Maple Leaf Lounges and thru the Visa Airport Companion Program, $100 NEXUS credit score, the power to earn an Annual Worldwide Companion Cross after spending $25,000 on the cardboard per yr†, and extra.

For Aeroplan members who’re working in the direction of elite standing, the cardboard additionally permits you to earn 1,000 Standing Qualifying Miles (SQM) and 1 Standing Qualifying Phase (SQS) for each $5,000 you spend on the cardboard† and the power to rollover as much as 200,000 SQMs and 50 eUpgrades per yr†.

Try our full information to Aeroplan Elite Standing to be taught extra about how these advantages can enhance your journey experiences.

The TD® Aeroplan® Visa Infinite Privilege* additionally comes with glorious insurance coverage protection for journey medical, flight delay and cancellation, automotive leases, and extra.

As a premium card with a excessive minimal revenue requirement and a substantial annual charge,

This card is right for frequent travellers with larger incomes who can take full benefit of the premium perks and robust base earn charge.

The cardboard can be a sensible choice for Air Canada frequent flyers given its glorious related perks.

For extra in-depth details about the TD® Aeroplan® Visa Infinite Privilege*, together with full particulars on its intensive perks, advantages, and insurance coverage protection, take a look at our devoted information.

TD® Aeroplan® Visa Infinite Privilege* Card

- Earn 20,000 Aeroplan factors† upon first buy

- Plus, earn a further 35,000 Aeroplan factors† upon spending $12,000 within the first 180 days

- Plus, earn a one-time anniversary bonus of 30,000 Aeroplan factors† upon spending $24,000 inside 12 months of account opening†

- Earn 2x Aeroplan factors† on eligible Air Canada® purchases, together with Air Canada Holidays®†

- Earn 1.5x Aeroplan factors† on eligible gasoline, groceries, eating, meals supply, and different journey purchases†

- Aeroplan most well-liked pricing, free checked bag, precedence check-in and boarding on Air Canada flights†

- Limitless Air Canada Maple Leaf Lounge† entry

- Visa Airport Companion Program membership with six free lounge visits per yr

- Minimal revenue: $150,000 private or $200,000 family

- Annual charge: $599

- Supply accessible for purposes authorised on or after January 7, 2025.

TD® Aeroplan® Visa Infinite* Card

The TD® Aeroplan® Visa Infinite* Card is TD’s mid-tier Aeroplan providing. It comes with a beneficiant welcome bonus and first rate incomes charges, and is a card that we suggest for all Canadian travellers.

The welcome bonus often hovers round 50,000 Aeroplan factors, which is usually greater than sufficient for a round-trip financial system flight inside continental North America.

The charges and eligibility necessities of this card are as follows:

- Annual charge: $139

- Supplementary cardholders: $75

- Minimal revenue requirement: $60,000 (private), $100,000 (family)

- Estimated credit score rating wanted: Good to Glorious

The incomes charges for the TD® Aeroplan® Visa Infinite* are first rate, with the notable elevated charge for gasoline and grocery spend.

The incomes charges for the TD® Aeroplan® Visa Infinite* are as follows:

- 1.5 Aeroplan factors† per greenback spent on eligible gasoline, grocery, and Air Canada® purchases, together with Air Canada Holidays®

- 1 Aeroplan level† per greenback spent on all different purchases.

For the reason that incomes charge for the gasoline and groceries class is identical with the TD® Aeroplan® Visa Infinite card as it’s with the premium TD® Aeroplan® Visa Infinite Privilege* card, we’ll merely remind you of the instance we used above.

When you have been to spend $1,000 monthly on gasoline and groceries, incomes 1.5 Aeroplan factors per greenback spent on this class, you’ll earn 18,000 Aeroplan factors ($1,000 x 1.5 earn charge = 1,500 factors x 12 months = 18,000 factors).

As we talked about above, these 18,000 Aeroplan factors might be redeemed on their very own for some North American flight choices, or alternatively, you may proceed to earn extra factors and save up for a flight additional overseas.

By way of perks and advantages, the TD® Aeroplan® Visa Infinite* affords cardholders a free first checked bag on Air Canada flights, most well-liked pricing when redeeming Aeroplan factors for Air Canada flights†, a $100 NEXUS credit score, and extra.

The cardboard additionally supplies sturdy insurance coverage protection for journey and automotive leases.

Given its sturdy welcome bonus, affordable annual charge, and good incomes charges and journey perks, we suggest the TD® Aeroplan® Visa Infinite* Card as one of many 4 important bank cards for Canadian travellers.

The TD® Aeroplan® Visa Infinite* is greatest suited to people who fly Air Canada at the very least yearly (to benefit from the free checked bag), and for many who can use it as a very good choice at grocery shops and gasoline stations (using the 1.5x incomes charge).

Nonetheless, we do really feel it’s essential to notice that there are higher bank card choices for grocery spending and incomes Aeroplan factors.

The American Categorical Cobalt Card earns 5 Membership Rewards factors per greenback spent at grocery shops, and these factors might be transferred to Aeroplan at a charge of 1:1.

That mentioned, the TD® Aeroplan® Visa Infinite* is a superb Visa choice for grocery shops that don’t settle for American Categorical, and for people who’d favor to maintain their wallets easy and solely carry one broadly accepted card.

When you’d wish to be taught extra concerning the TD® Aeroplan® Visa Infinite*, you’ll be able to peruse our in-depth information, which supplies an abundance of extra data.

TD® Aeroplan® Visa Infinite* Card

- Earn 10,000 Aeroplan factors† upon first buy†

- Plus, earn 15,000 Aeroplan factors† upon spending $7,500 within the first 180 days of account opening†

- Plus, earn a further 15,000 Aeroplan factors† on renewal once you spend $12,000 inside 12 months of account opening†

- Earn 1.5x Aeroplan factors† on eligible gasoline, groceries, and Air Canada® purchases, together with Air Canada Holidays®†

- Most well-liked Aeroplan pricing and free checked bag on Air Canada® flights†

- Minimal revenue: $60,000 private or $100,000 family

- Annual charge: $139 (rebated for the primary yr)

- Supply accessible for purposes authorised on or after January 7, 2025.

TD® Aeroplan® Platinum Visa* Card

The TD® Aeroplan® Platinum Visa* Card is TD’s entry-level providing, which regardless of its decrease revenue requirement, nonetheless comes with an honest welcome bonus, usually round 20,000 Aeroplan factors.

The charges and eligibility necessities for this card are as follows:

- Annual charge: $89

- Supplementary cardholders: $35

- Minimal revenue requirement: N/A

- Estimated credit score rating wanted: N/A

Moreover, this card typically comes with a first-year annual charge rebate.

The TD® Aeroplan® Platinum Visa* Card affords cardholders the prospect to earn Aeroplan factors on on a regular basis spending, with a barely elevated charge for gasoline, groceries, and eligible Air Canada purchases.

The cardboard’s incomes charges are as follows:

- 1 Aeroplan level† per greenback spent on eligible Air Canada®, Air Canada Holidays®, gasoline, and grocery purchases†

- 1 Aeroplan level† for each $1.50 spent on all different eligible purchases†

To get an concept of what these incomes charges can get you, let’s have a look at the identical $1,000 monthly spend on gasoline and groceries that we used above.

With the class incomes charge of 1 Aeroplan level per greenback spent, spending $1,000 monthly would earn you 12,000 Aeroplan factors over the course of a yr ($1,000 x 1x incomes charge = 1,000 factors x 12 months = 12,000 factors).

Wanting on the first band of Aeroplan’s North American redemption chart, we will see that 12,000 factors may doubtlessly get you a return flight in financial system class for a flight distance of as much as 500 miles.

It’s value noting that it may be tough to search out redemptions on the lowest finish of the factors vary; nevertheless, should you e-book far sufficient forward or on the final minute, these redemptions are actually accessible on eligible routes.

Along with the power to earn Aeroplan factors on all eligible purchases, the TD® Aeroplan® Platinum Visa* supplies cardholders with most well-liked pricing when redeeming Aeroplan factors for Air Canada® flights† and a few primary insurance coverage protection.

The TD® Aeroplan® Platinum Visa* is greatest suited to somebody who’s on the lookout for a low-cost bank card that may earn factors for journey or for somebody who’s working to construct/rebuild their credit score.

You possibly can be taught extra concerning the TD® Aeroplan® Platinum Visa* in our full in-depth information discovered right here.

TD® Aeroplan® Visa Platinum* Card

- Earn 10,000 Aeroplan factors† upon first buy†

- Plus, earn 10,000 Aeroplan factors† upon spending $1,000 within the first three months

- Earn 1x Aeroplan factors† on eligible gasoline, groceries, and Air Canada® purchases, together with Air Canada Holidays®†

- Most well-liked pricing on Air Canada® flights via Aeroplan†

- Annual charge: $89, rebated within the first yr†

- Supply accessible for purposes authorised on or after January 7, 2025.

Redeeming Aeroplan Factors Earned in your TD Credit score Card

When you’ve acquired a pleasant stack of Aeroplan factors, it’s time to start out exploring your redemption choices.

With a TD bank card, the factors earned via on a regular basis spending and the welcome bonus get deposited immediately into your Aeroplan account every month after your assertion posts.

As soon as the factors are in there, you’ll be able to redeem them for flights, motels, and extra, however as we talked about above, one of the best worth by far is discovered when redeeming your factors for flights.

Aeroplan factors might be redeemed for award flights with Air Canada, with the airline’s Star Alliance companions, and with its different companion airways. Because it stands, you’ll be able to redeem Aeroplan factors for flights with 45+ airways.

The Aeroplan reserving course of is each easy and closely nuanced, so the redemption course of can both be easy or extra difficult relying on how you’re in looking for one of the best worth in your factors.

Try our step-by-step information for reserving via Aeroplan’s portal. On this information, we do our greatest to demystify every step as a way to e-book with confidence.

We’ve additionally written extra concerning the redemption course of in depth in our Important Information to Aeroplan, so should you’d wish to study learn how to actually benefit from Canada’s greatest loyalty program, you’ll positively need to test it out.

The important thing factor to bear in mind when planning a flight redemption utilizing Aeroplan factors is that Air Canada flights are topic to dynamic pricing, which implies that the worth fluctuates relying on demand for the actual flight and seat.

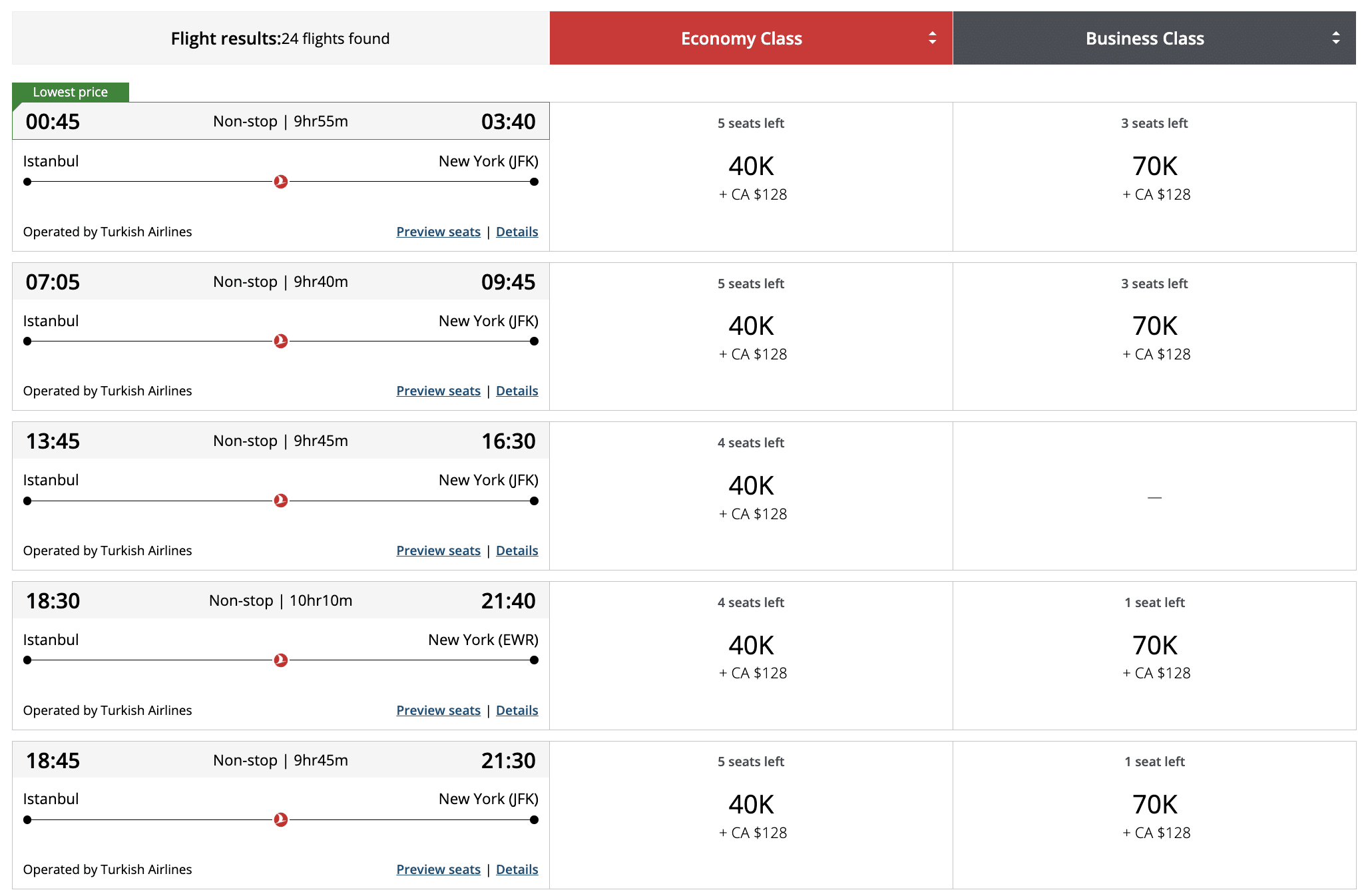

Comparatively, award flights with companion airways have static pricing however the availability of award seats is restricted since these airways will usually solely supply a portion of their seats for redemption bookings.

In easy phrases, to determine should you’re getting a very good deal in your award redemption, you’ll want to have a look at the Aeroplan Flight Reward Charts.

In every chart, lookup the beginning at costs for Air Canada flights and the singular value for reserving with companion airways.

For the Air Canada award bookings, if the flight you need to e-book is priced nearer to the beginning at value listed within the chart, that is typically thought-about a very good deal.

Likewise, if it’s priced a lot larger, above the median value, you might need to have a look at different dates or companion flights which have decrease pricing.

General, Aeroplan is a superb program, and one that you would be able to get increasingly from as you interact with it and perceive it higher.

We now have a wealth of assets on learn how to get essentially the most out of your Aeroplan factors, so be certain to check out our guides to be taught extra about Aeroplan and the unimaginable journey alternatives it opens up.

Conclusion

TD Financial institution affords three co-branded Aeroplan bank cards that assist you to earn Aeroplan factors.

Aeroplan is likely one of the greatest loyalty applications in North America and its factors can be utilized for priceless redemptions corresponding to flights, lodge bookings, and extra.

When you’re on the lookout for a bank card that earns Aeroplan factors redeemable for distinctive flight experiences, the TD Aeroplan playing cards are actually value contemplating.

When you’d wish to revisit the TD Aeroplan card choices, click on right here.

FAQs

Can I’ve a TD Aeroplan bank card if I don’t financial institution with TD?

Sure, you’ll be able to. To pay your TD Aeroplan bank card invoice with out a TD checking account, merely seek for TD as a payee inside your on-line banking’s invoice cost characteristic, after which add your TD bank card quantity because the account quantity.

Can I e-book journey for different folks with my Aeroplan factors?

Sure, you may make a reserving for another person utilizing your Aeroplan factors. To take action, undergo the search and reserving course of as regular inside the Aeroplan portal, utilizing your good friend/member of the family’s identify and knowledge in lieu of your personal.

Do I’ve to redeem my Aeroplan factors for journey?

No. Aeroplan factors can be redeemed for motels, automotive leases, merchandise, present playing cards, flight upgrades and extras, and journey actions and experiences.

Can I change my Aeroplan factors for money?

No, Aeroplan factors can’t be redeemed for money; nevertheless, they are often redeemed for a wide selection of present playing cards and merchandise.